Online reviews are a gold mine for marketers, and fortunately for you, the gold keeps growing.

Just four years ago, the volume of online reviews surged 87% year over year, according to McKinsey research. While the growth may have slowed, it hasn’t stopped and is expected to intensify.

And all that online feedback is tied to revenue. McKinsey found that even small gains in a product’s star rating can result in increased sales.

But for marketers, a different kind of gold can be discovered in those reviews – the power to discern potential needs and improvements to their messaging and products.

Gautam Kanumuru, CEO and co-founder of Yogi, walks through several brands that found the sparkle in customer reviews in his presentation at the Marketing Analytics & Data Science (MADS) conference.

Reviews act as digital focus groups

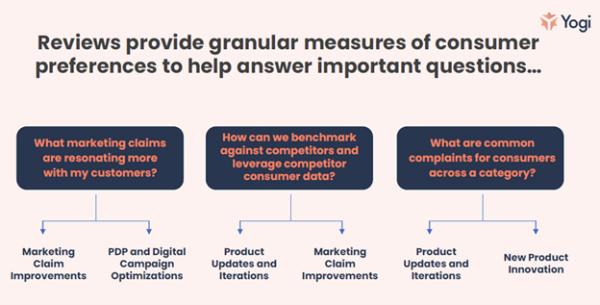

Think of ratings and reviews as unfiltered focus groups with tens of thousands of users. Reviews, Gautam says, provide granular measures of consumer preferences to assess answers to questions such as:

- What marketing claims are resonating with my customers?

- How can we benchmark against competitors and use competitor consumer data?

- What are the common complaints across a category?

By analyzing the reviews to answer those questions, you can improve your marketing claims and optimize product detail pages and campaigns immediately. By analyzing your competitors’ reviews, you can develop updates and new iterations of your products in the likely 12- to 18-month cycle. Assessing common complaints in the category could open your brand’s eyes to innovate new products in a similar timeframe.

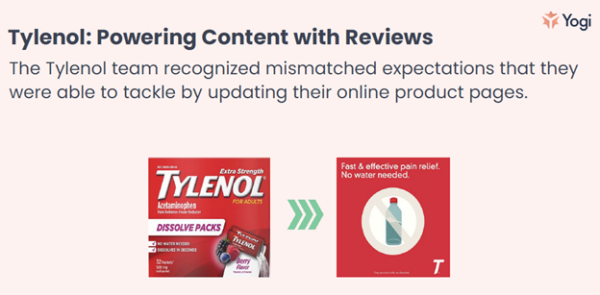

Example: Tylenol updates product label in response to reviews

Tylenol sells acetaminophen in Dissolve Packs – the product can be placed directly in the consumer’s mouth, where it dissolves on the tongue. Yet, what do many consumers do when they open a pack of powder? They add it to a glass of water where it sits on top and doesn’t dissolve.

Tylenol discovered consumers’ confusion after reading product reviews. Customers would leave comments such as, “This product doesn’t work. No matter how much water I poured onto it, no matter how much I shake, nothing is happening.”

While the original package included the text, “No Water Needed,” the print was small, and consumers weren’t paying attention to it. So, Tylenol updated the messaging, showing a water bottle with a line through it accompanied by the words, “Fast and effective pain relief. No water needed.”

Gautam says that this change has eliminated complaints about the product not dissolving. It also resulted in an increase in the product’s average star rating, which leads to more impressions, higher conversion rates, and more sales.

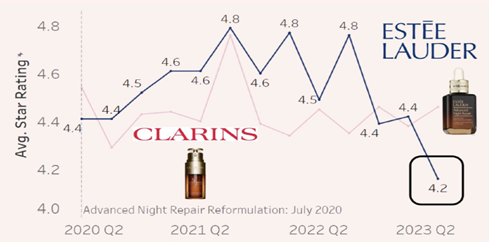

Example: Rating data clues Estée Lauder into reaction to formula change

Gautam collected rating data for night repair skin care products. He assessed more than 86,000 ratings from six sources, including Sephora, ULTA, and Nordstrom, for similar products from Estée Lauder and Clarins. The analysis revealed a drop in ratings for Estée Lauder when it changed the product’s formula. It went from a high of 4.8 out of 5 stars in the second quarter of 2022 to a low of 4.2 stars a year later, while Clarins held relatively steady around 4.4 stars.

The cosmetics industry relies on consumers who repeat purchases of infrequently purchased products like night cream. “If someone who’s used to purchasing this product has a negative experience [with the new formulation], it’s going to cause them to purchase something else the next time,” he says.

Now, Estée Lauder knows how consumers reacted to its formula change and can assess what, if any, product changes it wants to make going forward.

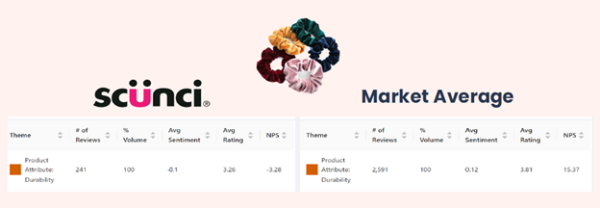

Example: Scünci, maker of scrunchies, analyzes marketing claim

Hair accessory brand Scünci makes marketing claims focused on the durability of its scrunchies — that they last longer than other brands. Gautam analyzed the reviews that mentioned durability and calculated their average ratings. Scünci’s durability-focused reviews averaged 3.26 out of 5, while reviews mentioning durability for all related manufacturers had an average score of 3.81.

Those findings prompted Gautam to say Scünci’s marketing claim around durability may need to be adjusted. If consumers buy the product for its durability and it falls short, their negative experience may lead to a poor online review.

“So maybe you have to reframe what you’re focusing on, what you say you’re best at, or two, this is a priority that has to be sent to the product team to kind of make improvements to understand what’s happening or probably a combination of the two,” Gautam says.

How to start analyzing reviews

Though the value of assessing online reviews is great, McKinsey notes that few companies have programs dedicated to the effort. Even if you don’t have the resources to devote a full-time person or team to customer review analysis, you should take some time to glean the benefits.

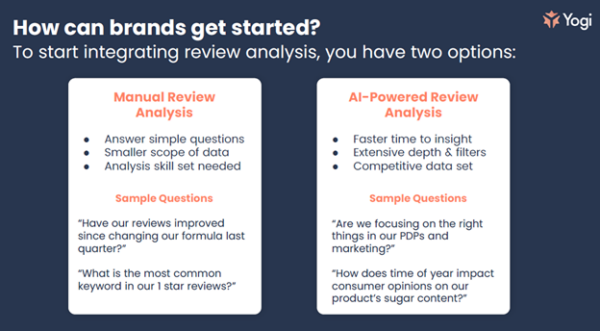

A team member with analysis experience could review the data manually to answer simple questions such as “Have our reviews improved since changing our formula last quarter? and “What is the most common keyword in our 1-star reviews?” To make the manual assessment more manageable, use a smaller scope of data.

If you can devote more resources, licensing or building an AI-powered tool can be helpful. It will give insight more quickly, deepen the analysis, allow for filters, and create competitive data sets. Among the sample questions to consider: “Are we focusing on the right things in our product description pages and marketing? and “How does time of year impact consumer opinions in our product’s sugar content?”

Gather B2B consumer data

Gautam’s examples focused on B2C brands, but the process works similarly for B2B brands, too. I once helped establish a ratings and review program for a B2B software company. Here’s how you can get started:

- Enable customers to leave ratings and reviews on your website (e.g., product pages). Helpful tools include Trustpilot and TrustRadius.

- Publish your average ratings and customer reviews on your website.

- Claim your product listings on review sites like G2, Capterra, and Gartner Peer Insights.

- Work with internal teams (e.g., sales, customer success, customer support) to invite customers to leave ratings and reviews on your website and on external review sites.

- Monitor and review the ratings and reviews. Escalate any observed issues to the appropriate team or executive.

- Share product feedback from reviews with product teams.

Go for the gold

Whether B2C or B2B, ratings and reviews offer a gold mine of data. Use Gautam’s insights to start your ratings/review program or take an existing program to the next level. It can be a great opportunity to increase the marketing team’s value throughout your organization. Let me know how it goes, and I might leave you a 5-star rating.

All tools mentioned in this article were suggested by the author. If you’d like to suggest a tool, share the article on social media with a comment.

HANDPICKED RELATED CONTENT:

Cover image by Joseph Kalinowski/Content Marketing Institute