WordPress has held the dominant share of the content management systems (CMS) market since it was launched in 2003.

Currently, the popular platform stands at 62.2% market share, according to W3Techs, which offers the most reputable and trustworthy data source. But in the last two years, WordPress has seen it’s market share start to reduce for the first time.

In this report, you’ll learn about the size of the CMS market, how it has evolved over the past decade, how different content management systems stack up against one another, and why this matters for someone working in SEO.

How Large Is The CMS Market?

According to W3Techs, 70.2% of websites have a CMS, and Netcraft reports 1.13 billion live websites.

From this, we can assume that the current market size for content management systems is approximately 793 million websites.

Top 10 CMS By Market Share (Globally)

| CMS (as of November 2024) | Launched | Type | Market Share | Usage | |

|---|---|---|---|---|---|

| No CMS | 29.8% | ||||

| 1 | WordPress | 2003 | Open source | 62.2% | 43.7% |

| 2 | Shopify | 2006 | SaaS | 6.6% | 4.6% |

| 3 | Wix | 2006 | SaaS | 4.5% | 3.2% |

| 4 | Squarespace | 2004 | SaaS | 3.1% | 2.2% |

| 5 | Joomla | 2005 | Open source | 2.3% | 1.6% |

| 6 | Drupal | 2001 | Open source | 1.3% | 0.9% |

| 7 | Adobe Systems (Adobe Experience Manager) | 2013 | Open source | 1.2% | 0.9% |

| 8 | Webflow | 2013 | SaaS | 1.1% | 0.8% |

| 9 | PrestaShop | 2008 | Open source | 1.0% | 0.7% |

| 10 | Google Systems (Google Sites) | 2008 | Online application | 0.9% | 0.6% |

Data from W3Techs, November 2024

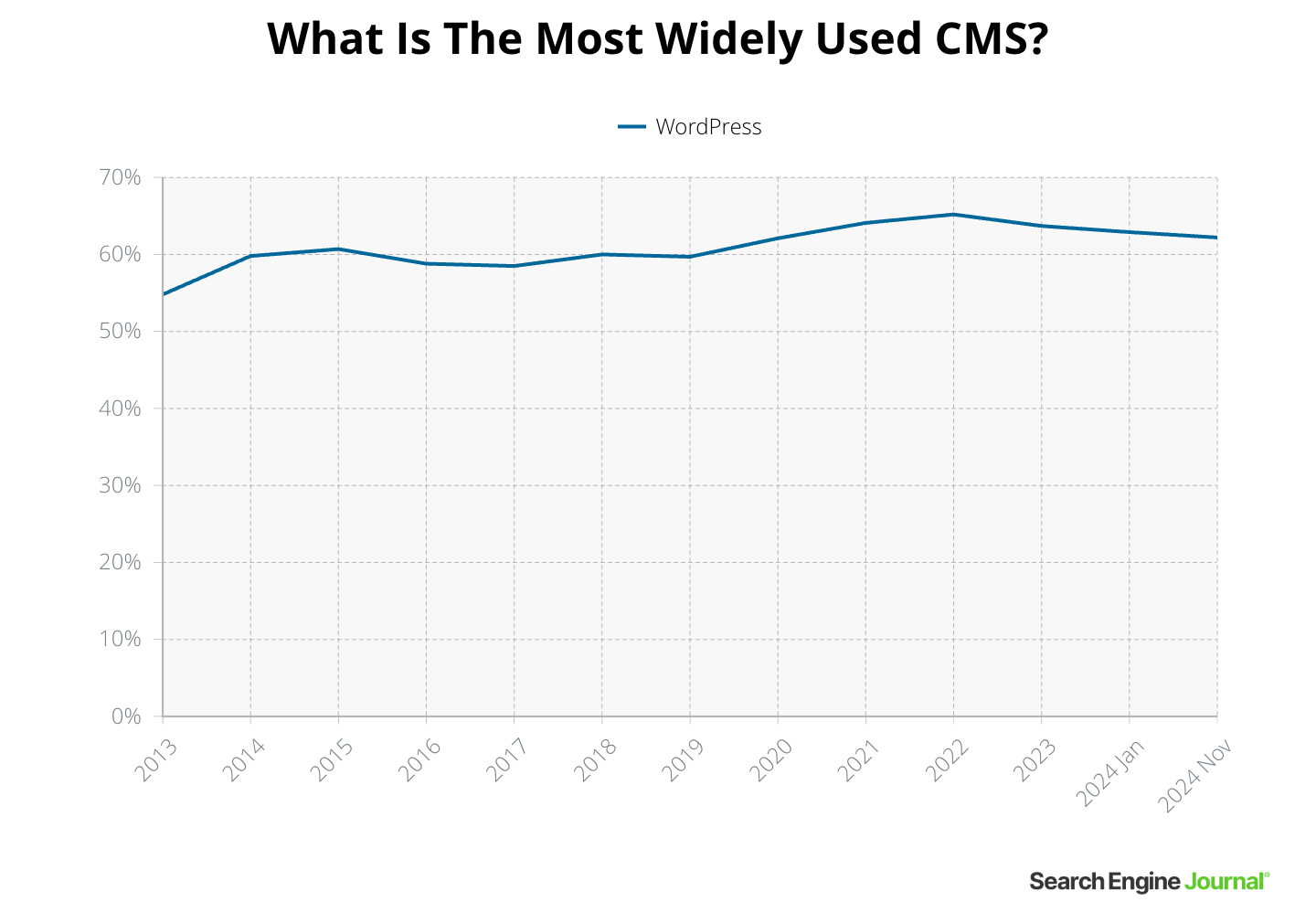

What Is The Most Widely Used CMS?

*Graphs are separated due to the dominance of the WordPress market share.

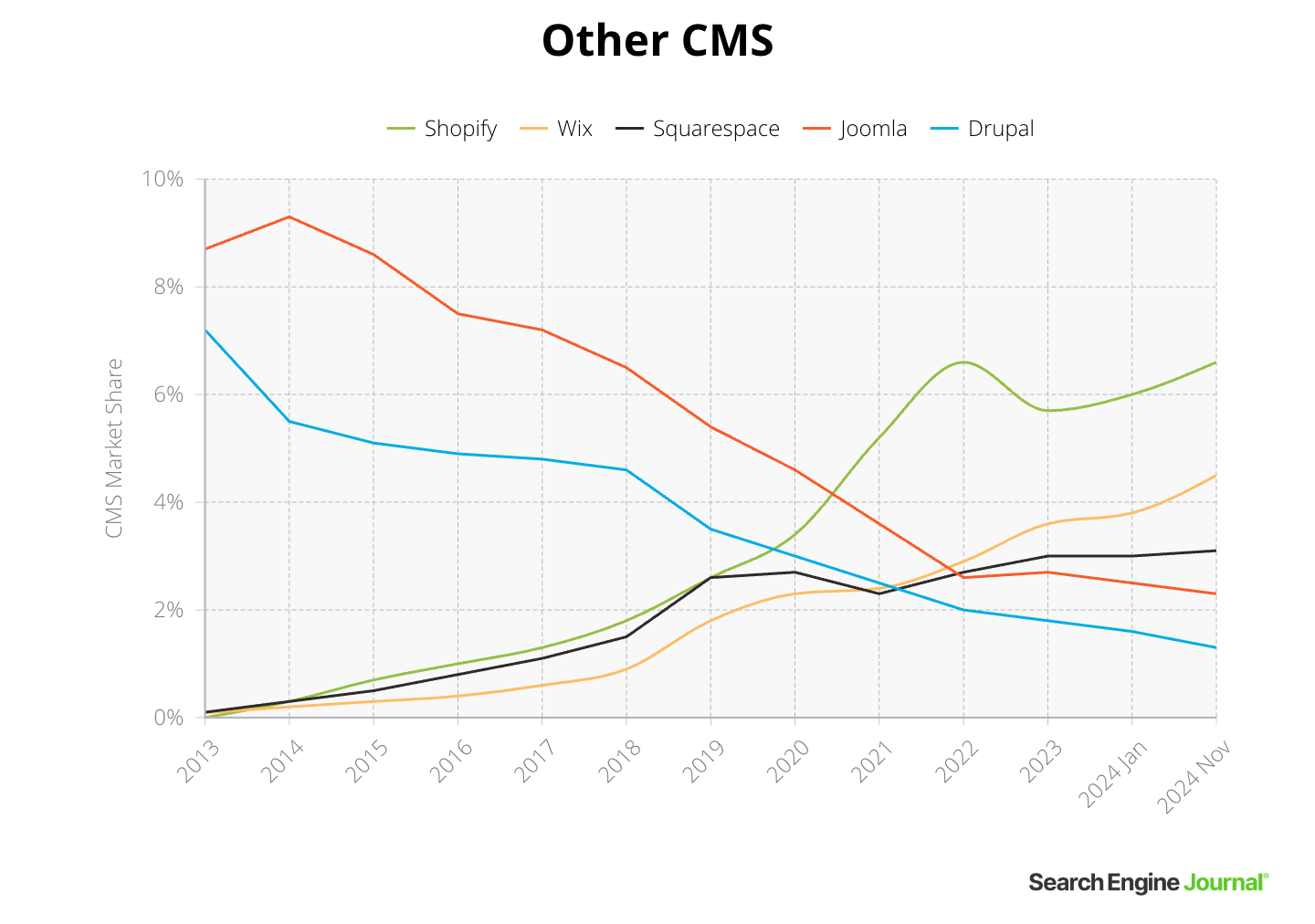

- WordPress’s market share has reduced by nearly 5% in the last two years. This could possibly continue with the issues it has experienced this year.

- Shopify’s market share took a dip of almost 14% in 2023, but it bounced back and gained some ground this year.

- Wix’s market share is on the upswing, with just over 3% of all websites using its platform. This could be attributed to the work they do on branding.

- Joomla and Drupal are seeing a downward trend lately, while Duda is gaining some momentum, which could be attributed to the efforts of leveraging influencers for their webinars.

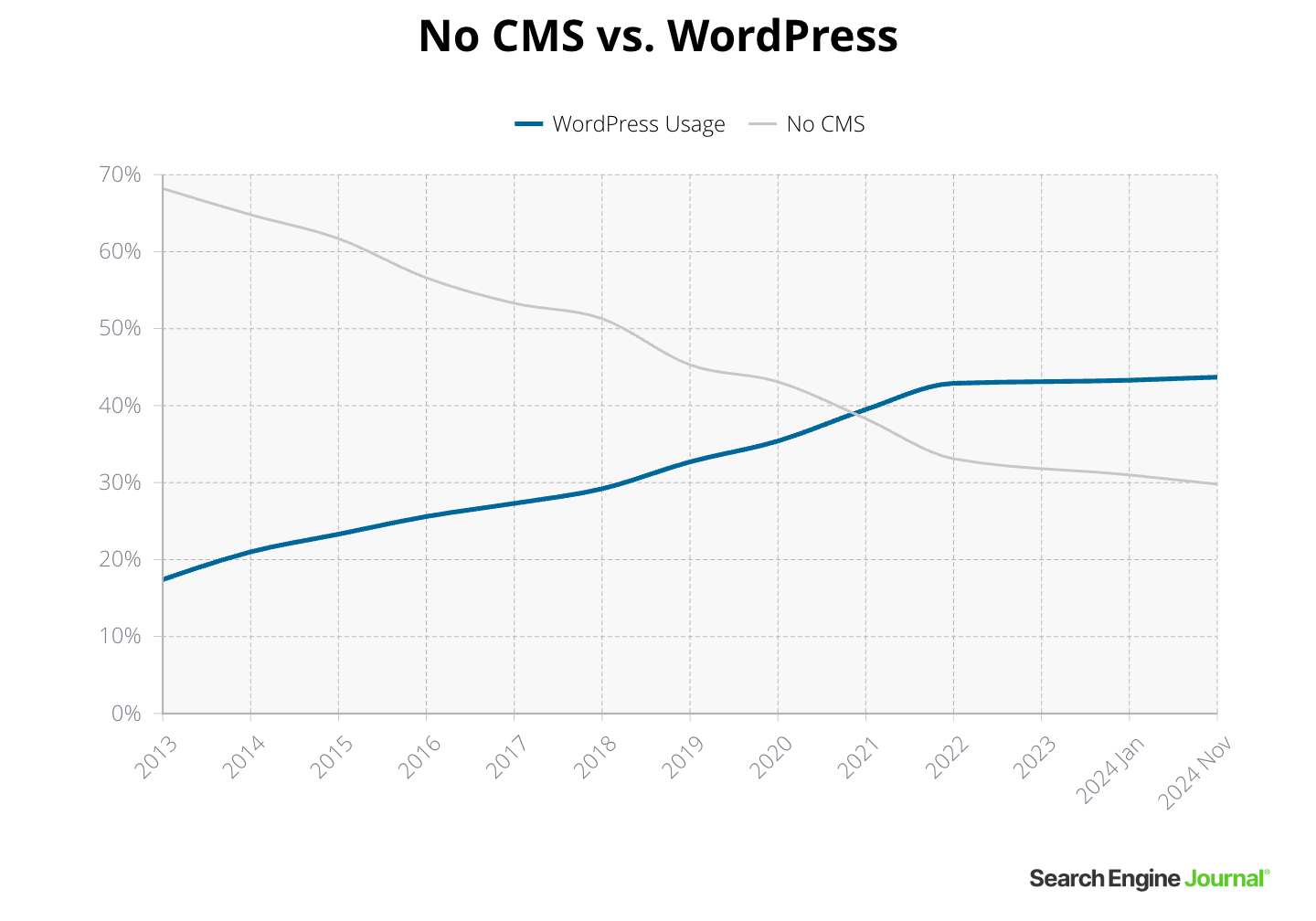

WordPress has held the dominant market share almost since its launch in 2003.

From 2013 to 2022, it experienced strong growth of 148%. WordPress then peaked at 65.2% market share back in January 2022, but, in the last two years has started to contract by nearly 5%.

Between 2023 and 2024:

- Websites with no CMS system have declined by nearly 8%.

- Websites with WordPress have increased by just over 1%.

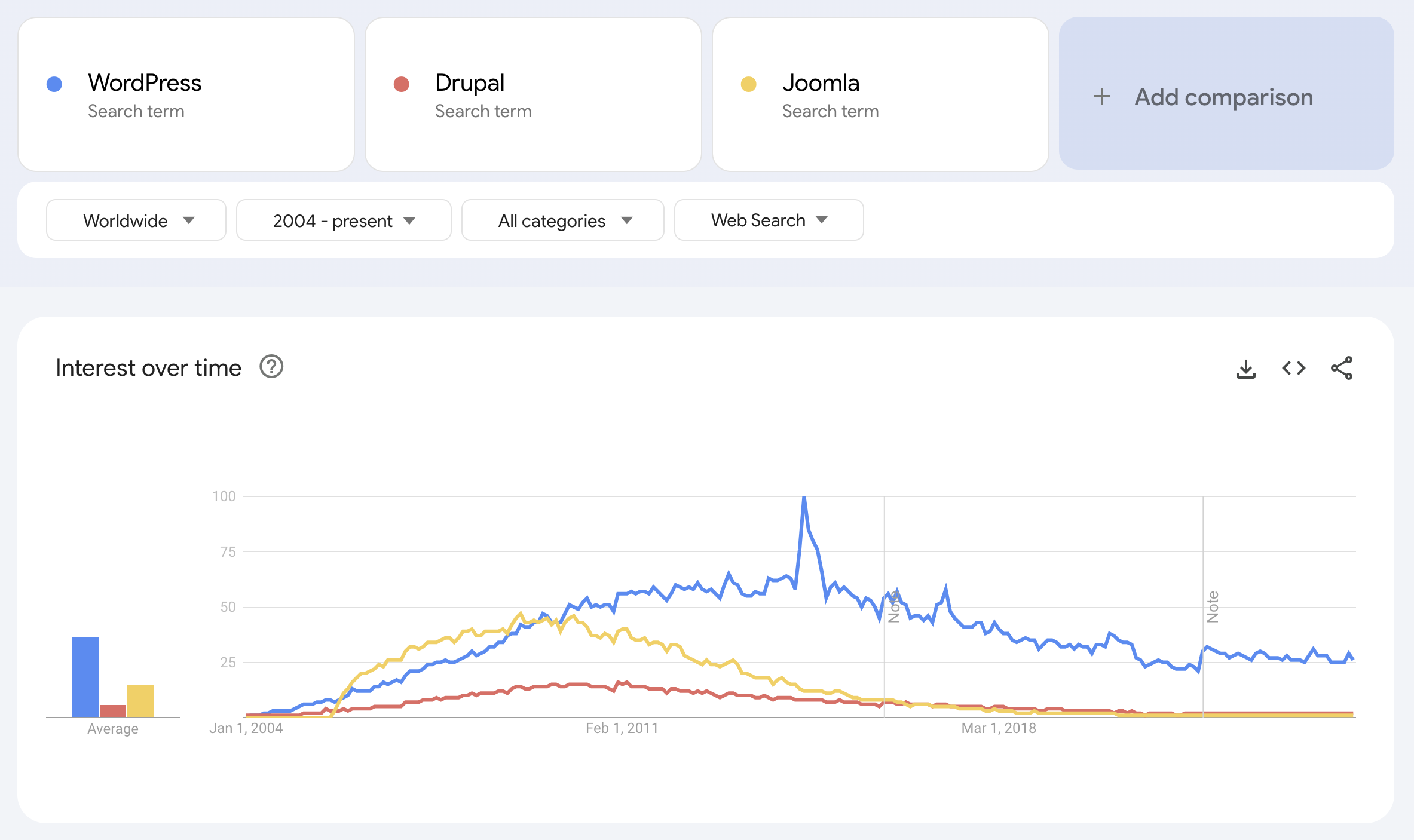

WordPress Vs. Joomla Vs. Drupal Market Share

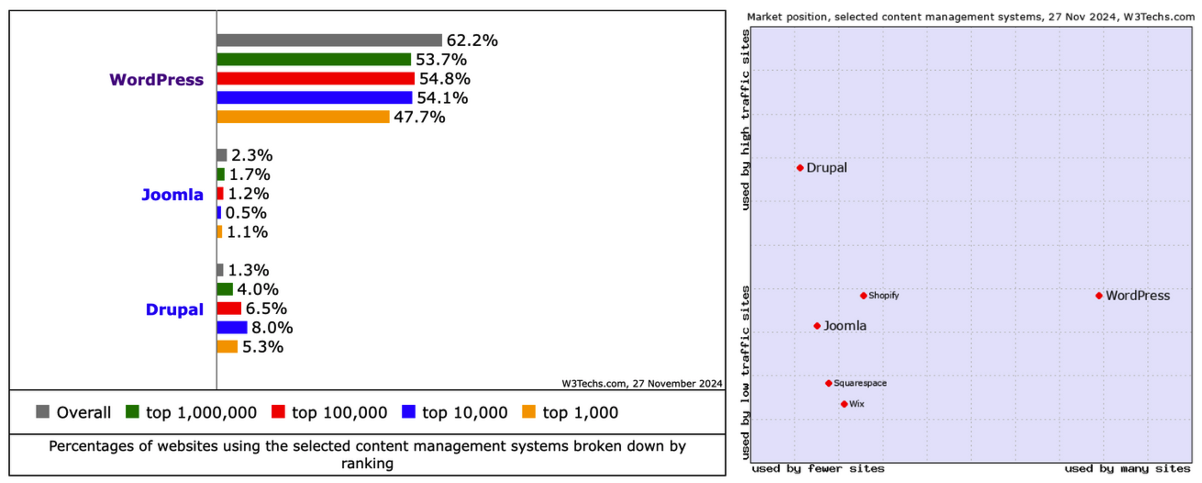

Screenshot from W3 Techs.com, November 2024

Screenshot from W3 Techs.com, November 2024- Since 2023, Joomla has decreased its market share by nearly 15%.

- Since 2023, Drupal has decreased its market share by nearly 28%.

In 2013, Joomla and Drupal used to hold 15.9% of the CMS market share, but they have slumped to 3.6%.

This decline has seen them drop from positions 2 and 3 to 5 and 6, as Wix and Squarespace have risen and finally superseded them in 2022.

That’s quite a decline for Joomla, which might not have had the same market share as WordPress, but up to 2008, it had more search interest, according to Google Trends.

Screenshot from Google Trends, November 2024

Screenshot from Google Trends, November 2024Why did these popular content management systems decline so much?

It’s most likely due to the strength of third-party support for WordPress with plug-ins and themes, making it much more accessible.

The growth of website builders, such as Wix and Squarespace, indicates that small businesses want a more straightforward managed solution. And they have started to nibble on market share from the bottom.

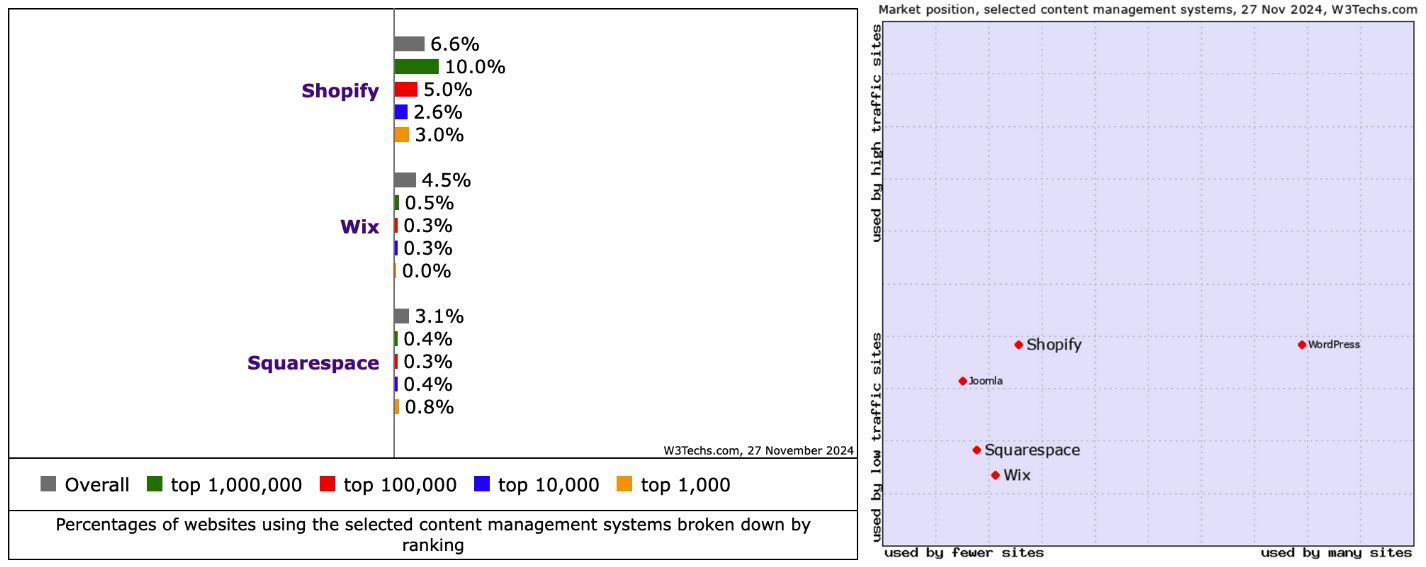

Website Builders Market Share: Wix Vs. Squarespace

Screenshot from W3 Techs.com, November 2024

Screenshot from W3 Techs.com, November 2024- Wix has increased by 18.4% this year, from January to November.

- Squarespace has increased by 3.3% this year from January to November.

If we look at the website builders, their growth is a strong indication of where the market might go in the future.

From 2023 to 2024:

- Shopify grew by 15.8%.

- Wix grew by 25%.

- Squarespace grew by 3.3%.

When we compare the 5% contraction of WordPress over the last year to the other players, we have to ask, why is that happening?

SaaS web builders such as Wix and Squarespace don’t require coding knowledge and offer a hosted website that makes it more accessible for a small business to get a web presence quickly.

No need to arrange a hosting solution, install a website, and set up your own email. A web builder neatly does all this for you.

WordPress is not known as a complicated platform to use, but it does require some coding knowledge and an understanding of how websites are built.

On the other hand, a website builder is a much easier route to market, without the need to understand what is happening in the back end.

Consider that, during the pandemic, much of the population worked from home, leading to more interest and attention placed on how being online could be a source of income.

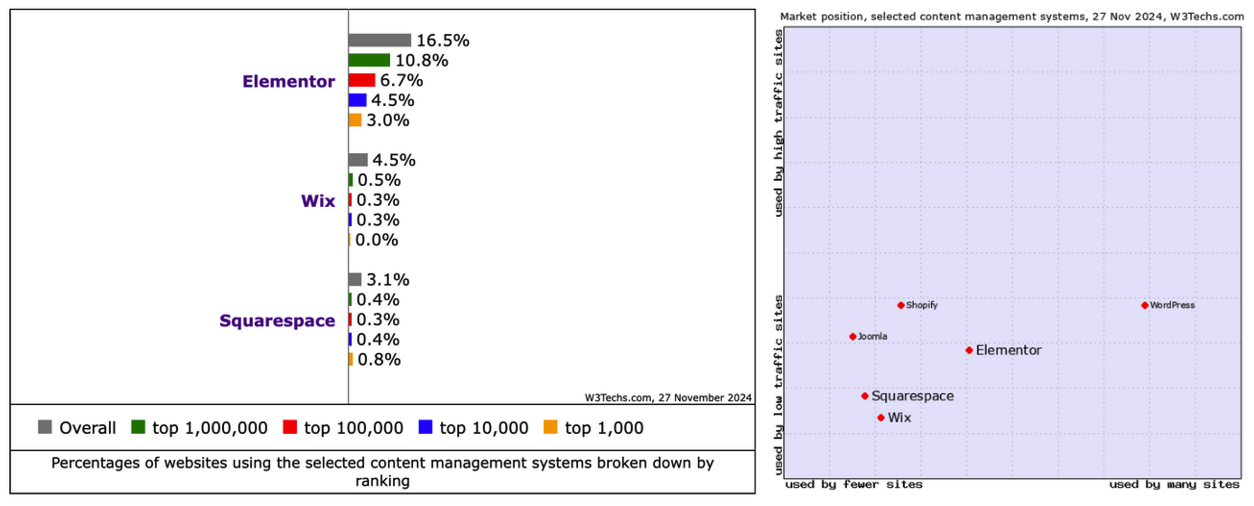

Elementor

Elementor is a WordPress-based website builder that has a market share of 16.5% and is used by 11.6% of all websites.

Screenshot from W3 Techs.com, November 2024

Screenshot from W3 Techs.com, November 2024It also has significantly more market share than Wix and Squarespace combined.

However, because it’s a third-party plug-in and not a CMS, it isn’t listed in the Top 10 CMS above.

If we compare the volume of traffic to the number of CMS, we can see that WordPress is in the golden section, up and to the right, clearly favored by sites with more traffic.

Joomla fits into a niche of fewer installs but more high-traffic sites, indicating that more professional sites are using it.

Squarespace and Wix are to the left and down, highlighting that they are installed on fewer sites with less traffic.

This is a strong indication that they are used more by small websites and small businesses.

Elementor bridges the gap between the two and has the weight of the WordPress market share, but is used by sites with less traffic.

The appetite is growing for drag-and-drop, plug-and-play solutions that make having a web presence accessible for anyone. This is the space to watch.

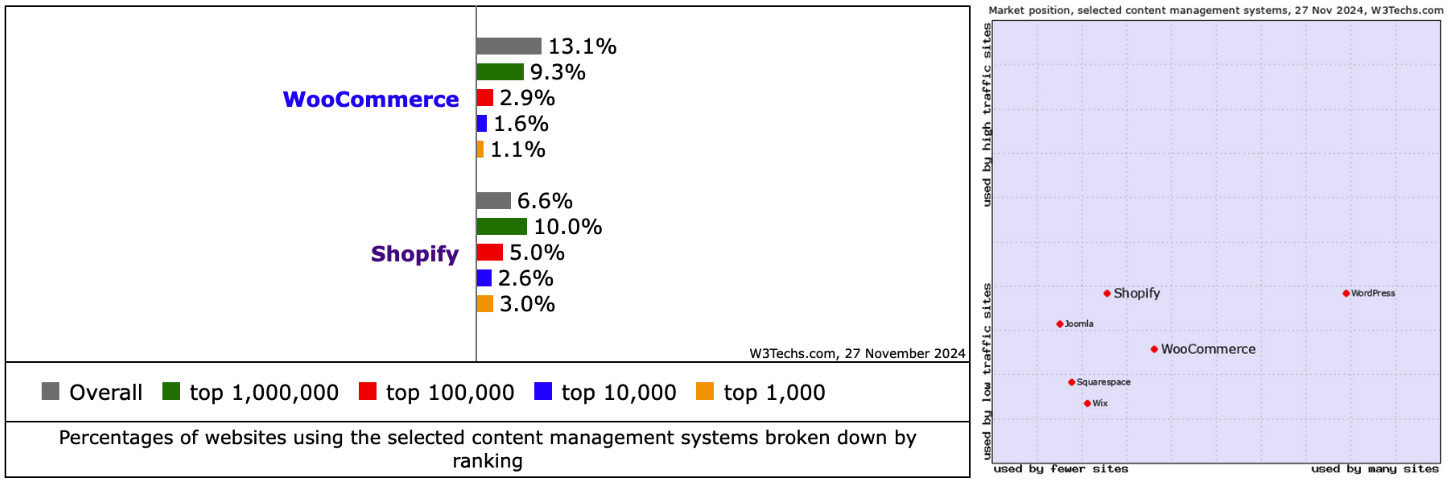

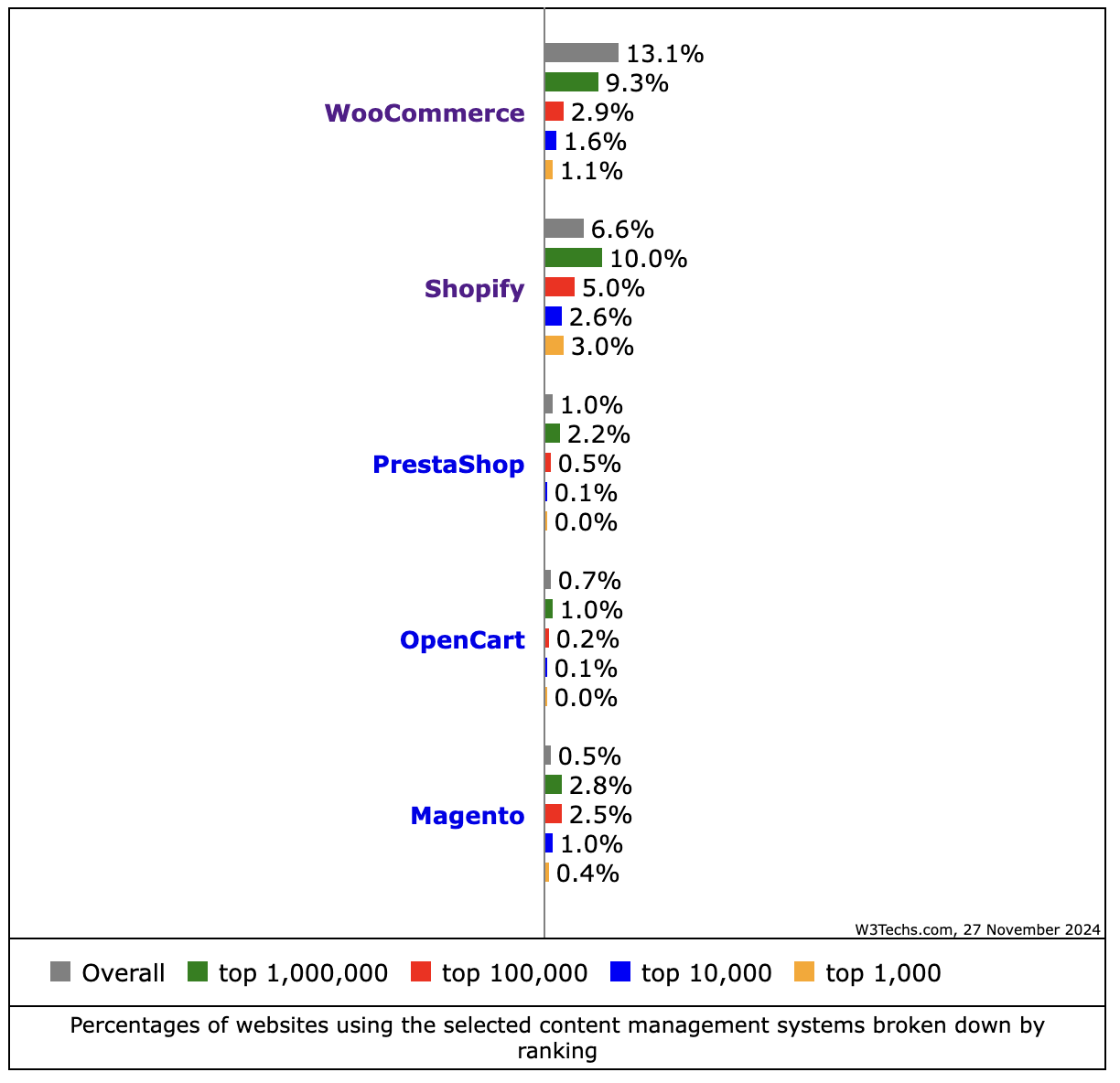

Ecommerce CMS Market Share: WooCommerce Vs. Shopify

Screenshot from W3Techs, November 2024

Screenshot from W3Techs, November 2024- WooCommerce has a market share of 13.1%.

- Shopify has a market share of 6.6%.

The ecommerce CMS space echoes a pattern similar to that of website builders.

Technically, WooCommerce is not a standalone CMS, but a WordPress plug-in – which is why it doesn’t appear in the Top 10 CMS data table.

However, it’s essential to the ecommerce space, so it’s worth considering and mentioning.

9.2% of all existing websites use WooCommerce.

Looking at the distribution, we can see a clear pattern emerge. In comparison to other ecommerce CMS platforms, WooCommere is dominant.

It has more market share than its competitors combined: Magento + OpenCart + PrestaShop + Shopify = 8.8% market share.

Screenshot from W3Techs, November 2024

Screenshot from W3Techs, November 2024Smaller sites might favor WooCommerce, but it has the WordPress platform’s weight for market access and, therefore, more installs – much like Elementor.

Shopify has more market share, but the traffic levels are similar to WordPress.

Shopify saw growth during the pandemic, by 52.9% from 2020 to 2021 and then 26.9% from 2021 to 2022 – far more than any other platform. After that, it retracted in 2023, but in 2024 has come back to the same market share as 2022.

Why Does CMS Market Share Matter To Someone Working In SEO?

WordPress retains its dominance in the CMS market share, but website builders such as Wix, Squarespace, and Shopify are on the rise, indicating where market growth lies, especially for small businesses.

If more small businesses are switching to website builders, understanding the limitations and intricacies of these platforms for SEO could be a competitive advantage.

Shopify is installed on 4.6% of all websites (not just sites with a CMS) – a total potential market of 51.98 million websites.

With their increasing market share, specializing in Shopify SEO could be a strategic move for an SEO professional.

Similarly, specializing in Wix and Squarespace is a way to differentiate yourself from the competition.

WordPress might be dominant now, but that also means that many other people are servicing that specific CMS.

Aligning with a more niche CMS can be a strategic move for new client opportunities.

More resources:

All data collected from W3Techs, November 2024, unless otherwise indicated.

W3Tech samples its data from the Alexa top 10 million and Tranco top 1 million. Websites with no content or duplicate sites are excluded. Limitations of the data source mean that hosted Tumblr and WordPress.com sites are not included, as the data collection doesn’t count subdomains as more than one site.

Featured Image: Genko Mono/Shutterstock