The opinions expressed within this story are solely the author’s and do not reflect the views and beliefs of Search Engine Journal or its affiliates.

With the looming economic challenges, consumers are scrounging everywhere to save money.

After receiving consumer pushback from raising its subscription prices, Netflix rolled out its newest tier: Basic with Ads, in November 2022.

The ads tier subscription is $6.99 per month – almost 55% lower per month than its Standard subscription.

While the monthly cost is lower for consumers, the newest tier comes with hidden price tags.

Unpredictable Ad Timing

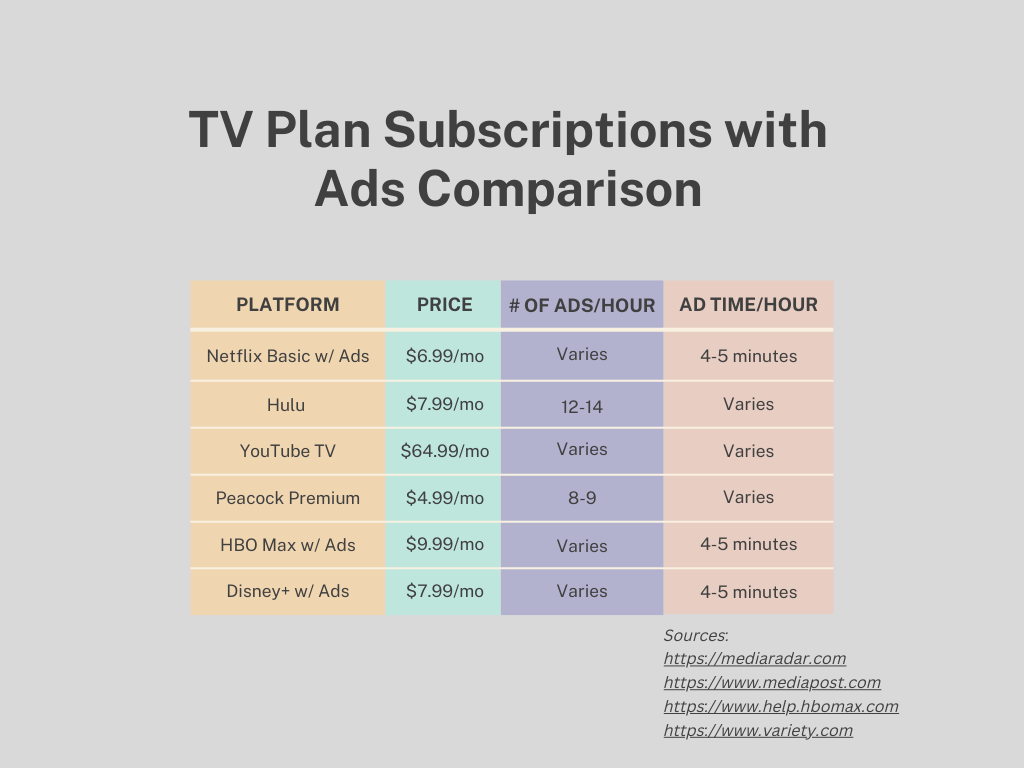

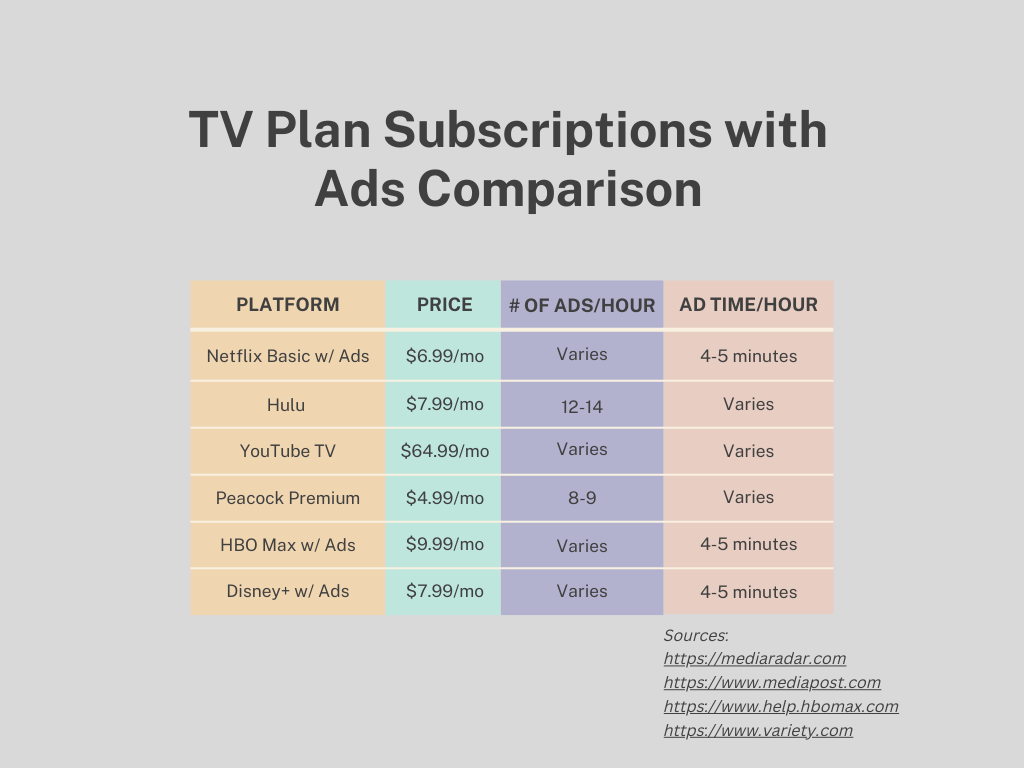

In the new Netflix Basic with Ads tier, users can expect around 4-5 minutes of ads per hour.

How is this comparable to other Connected TV subscriptions?

Image credit: Table created by the author, November 2022. Sources of information are linked in the image.

Image credit: Table created by the author, November 2022. Sources of information are linked in the image.

While the amount of ad time per hour for Netflix is comparable to other streaming services, the lingering issue is when an ad will show. Ad timings are unpredictable, which interrupts the user experience.

The video content for ads is about what you expect compared to other streaming services. But the same issue is at hand – when will this show up in a user’s watching experience on Netflix?

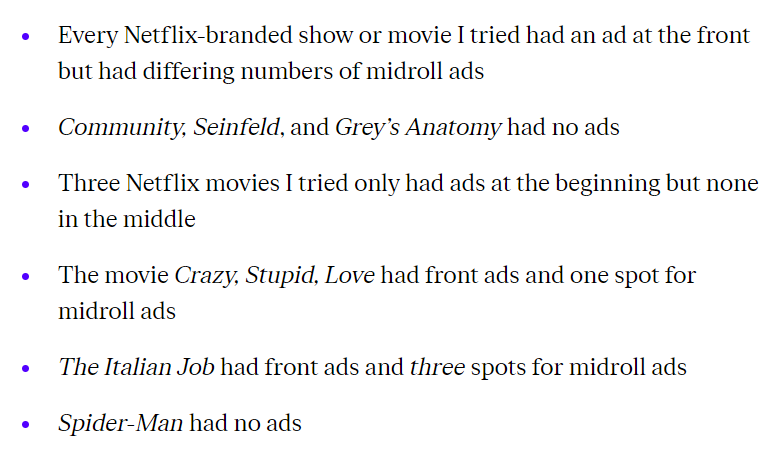

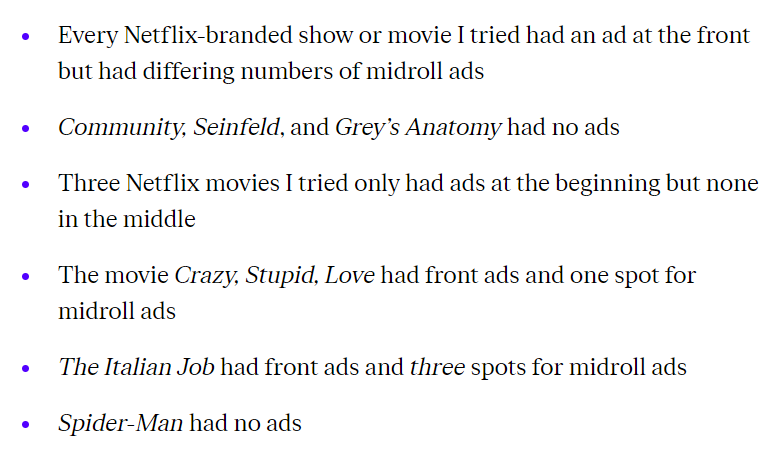

According to Jay Peters from The Verge, a user’s ad experience varies dramatically between types of content consumed:

Image credit: Jay Peters, TheVerge.com

Image credit: Jay Peters, TheVerge.com

As you can see from this example, the amount of ads, as well as the placement of ads, is inconsistent, which leads to believe that Netflix is testing to find the best engagement for not only users but advertisers.

Specific Titles Come With A Premium Price

The second nuance with Netflix Basic with Ads tier comes from what shows and movies are offered at this level.

Similar to the unpredictable ad experience, the available titles on the Basic tier seems extremely scattered without a rhyme or reason.

The restriction shouldn’t come as a surprise to users, as Netflix announced this back in July.

Titles that aren’t available for Basic users will show a red padlock, indicating that it is restricted.

The red padlock seems to be a passive “Call to Action” because users can click on the padlocked title, which takes them to an upgrade screen.

I theorize that Netflix’s subscriber strategy is to entice new users to the service or get previous subscribers to come back at a Basic price level. This can help grow and scale their subscriber numbers after tumbling since increasing prices.

Once a user is in, restricting titles that may be a “must have” for users attempts to show users the value of upgrading.

How Can Advertisers Forecast Connected TV Engagement?

Connected TV ads aren’t new to consumers. Brands spent over $400 million in ads on Hulu alone in 2021.

In economic uncertainty, consumers may be willing to sacrifice their viewing experience to include ads while trying to save money. But if the viewing experience dwindles, consumers may be less inclined to engage with Connected TV ads.

While it’s too early to tell about Netflix Basic with Ads, a common gripe from consumers on other streaming services is the lack of variety in ads.

Back in 2021, Morning Consult conducted a poll to consumers about their experience with streaming services ads. According to the survey:

- 69% of users thought the ads they received were repetitive

- 79% of users were bothered by that experience

So, what does this mean for advertisers?

Depending on how you look at it, marketers could see this as:

- An opportunity. If there are so many repeated ads, this could mean that competition is low on Connected TV/OTT. If this is the case, the opportunity for brand awareness could be more cost-effective for you before the OTT market becomes too saturated.

- A sign to stay away. If streaming services don’t fix the consumer’s viewing experience, users are less likely to engage with ads. And if titles are being restricted at a higher rate, consumers may churn off at a faster rate than before. This, in turn, means a high Cost Per Engagement for advertisers. This could be a more risky investment for brands with restricted budgets.

Summary

The newest Netflix price tier allows them to compete with other streaming services at a lower price. It’s an excellent strategic move on their part, and it opens up the OTT space for advertisers to get in front of users who may not use other streaming services.

While the plan type is new, Netflix (as well as advertisers) should monitor user engagement closely and make any strategic pivots necessary to maximize engagement and subscriber growth.

While Netflix ads are open to larger ad companies, I expect them to roll out an in-house advertising platform similar to Hulu sometime next year.

Have you tried Connected TV/OTT ads yet? What has been your experience? Are they worth the investment?

Featured Image: Koshiro K/Shutterstock