If you haven’t set up a 2024 game plan, you’re not alone. Many search engine marketers and PPC professionals are late, or just terrified of what is to come this year.

I recognize most of us have still not recovered from the dumpster fire that was 2020 (just look at my beloved NY Jets as an example), but you can work through that later.

2023 didn’t really bring us new pains; it just embellished things that already upset us (e.g., Meta’s Advantage+, Google’s PMax, Google Analytics 4, fears of a recession, and so much more).

But one thing it didn’t do for us was give us much guidance for 2024.

Recession fears are largely gone, the presidential election is looming, interest rates are high (yes, that does play into your planning), and cookie deprecation has actually started.

Take a moment to accept that 2024 is going to be a rollercoaster. Have a cup of coffee, and let’s dig into what you need to know for this year.

Pro tip: Plan for at least three seasons:

- Pre-Election (January-August).

- Election (September-November 5th).

- Post-Election (November 6th-December).

Within that, you can add your seasonality (and if your peak season is in that election period season, get ready for a ride).

How Strategic Planning Typically Goes In Search Marketing

Disclaimer: Normally, this process applies if you’re working toward the same game plan as the prior year – without dramatic, sweeping changes. But in 2024, we throw in new macro factors that will throw you some curveballs.

The most common way New Year search planning happens is by examining historical data. Here, you examine YoY growth in costs per click – in addition to annual search activity growth – to estimate necessary budgets.

But when Google search produces abnormally high cost-per-click (CPCs) in Q2 of 2022, you must adjust for unexpected changes the following year after completing four fiscal quarters to offset it.

The search engine does all of this, so you end up with behavior for Google Ads, Bing Ads (because I refuse to call it Microsoft), Meta (yes, paid social is more or less paid search these days), and other non-typical platforms (e.g., Yelp, TikTok, Nextdoor, Pinterest, Amazon, etc).

You examine seasonal, monthly, and even day-of-week behavior across all your campaign segments, including Product Listing Ads (PLAs), Performance Max, brand, non-brand, high volume, etc.

Once this is done, you look for front and back-end traffic variances over the past two years.

But you should also revisit data from 2020 and 2016 (if available), specifically during the election season, to see if there is any other abnormal activity. You’ll need to account for variances like that in your planning.

You’re looking for highs or lows caused by time or macro factors that often repeat annually or are a one-and-done scenario.

We call this a “Forensic Lookback” – think of international impacts such as world events, major hurricanes, Supreme Court rulings, etc.

If you look at your 2023 data and find an out-of-character pattern in the numbers that cannot be attributed to a change you made, then see if the date when the data behavior changed correlates to any major event.

You’re probably keeping a close eye on impression share data (especially impression share lost); this will be helpful to correlate alongside your peak and low seasons.

Cross-reference it with total impressions and investment. Remember, this is valid for search, Google Display Network (GDN), and Shopping only – not eligible for PMax or social.

Net-net, the valuation of impression share, should be devalued if you’re already running Performance Max.

Then, you apply expected growth, increase in spend, etc., across 365 days, flexing up or down for recurring seasonal (and your anticipated adjustment for the election cycle), quarterly, monthly, weekly, or daily events.

And boom! Your anticipated needs and delivery for 2024 are all put together in a nice, neat little package.

Except you forgot about the increased adoption of Performance Max and its unpredictability.

If you carry over a PMax campaign, use the performance planner to guestimate the future.

If you don’t have one inherited campaign, you can still use the performance planner, but take it with a grain of salt because it is more accurate with historical data. This is all a nice way of saying, “Launch with a predetermined budget, but make funds fluid between search/PLA/PMax.”

Separately, you’ll do traffic estimates via reach planner for YouTube and Meta, and use historical data cross-planning with estimated audience sizes the platform pushes out to you.

What Keeps Seasoned Pros Up At Night When Planning For 2024?

2020 and 2023 hindsight will provide 2024 foresight.

Unless you don’t care about anything or operate in a vertical that is somewhat immune to macro factors (I used to say worm farming was immune to these factors, but courtesy of inflation and homesteading booms, it’s not the case anymore).

So, at least we know some of what we’re facing this year and how to plan for potential impact.

These include, but are not limited to:

- Residual impact from the pandemic: Deeper pushed into the work-from-home model, which hampered verticals such as apparel and dining.

- Recovery from the pandemic: Travel demand surged, exceeding pre-pandemic levels.

- Interest rates: High-interest rates led to a massive drop in loan-based marketing and indirectly negatively affected automotive sales. Inversely, this positively impacted retail financial marketing, such as checking and savings accounts.

- Election season: This hit some verticals more than others, as politicians ran ads that targeted key terms in adjacent/halo categories, such as Medicare/insurance, healthcare, and law.

- Non-market related incidents: Wars, mass shootings, political fighting, and court rulings immediately cause brand safety concerns and may limit what is possible to advertise near for display, social, and video.

- Non-traditional SEM adjacent advertising: The continued evolution and adoption of elements, such as Performance Max in Google (and soon in Bing) and YouTube, make your search forecasting more difficult.

Planning Search For 2024, Step By Step

So, what are you supposed to do now?

Don’t panic, but you need to get to it as soon as possible.

Depending on your vertical, you may need to account for collateral impact from the election, which we’ll note in later steps.

For those of you who are exclusive search and/or PLAs, this will be a bit easier.

For users of any of the following, there is a bit more legwork: PMax, GDN/Microsoft Audience Network (MSAN), and YouTube.

For those who are search-dominant or exclusive, I recommend the following steps, provided you are keeping the same objectives.

1. Pull January to August data from 2023 over 2022.

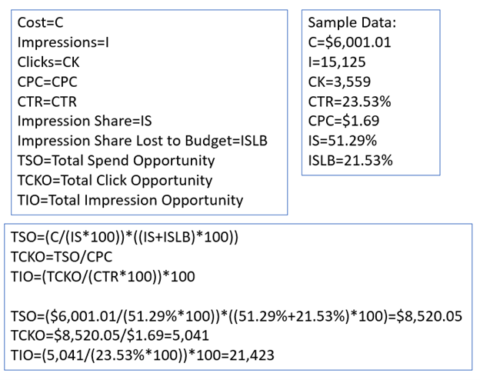

2. If you lost impression share due to budget, identify which campaigns and months.

Then, determine the opportunity if you weren’t underfunded. (See the fun little equation below.)

-

Calculation Of Actual Impression Share Data for Budget by author, November 2021

Calculation Of Actual Impression Share Data for Budget by author, November 2021

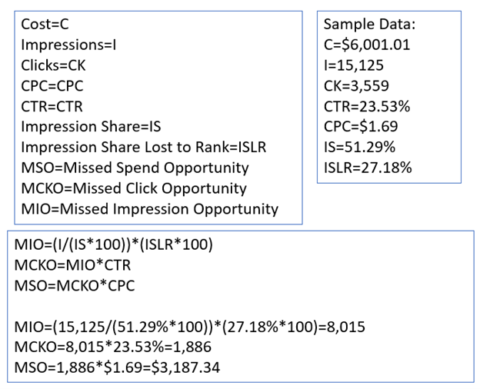

3. Take it a step further.

You can calculate the missed opportunity due to missed impression share due to rank.

I first learned about this formula in PPC Math Made Easy by Rachel Law in 2019, and I find it pretty accurate.

-

Calculation Of Actual Impression Share Data for Rank by author, November 2021

Calculation Of Actual Impression Share Data for Rank by author, November 2021

4. Add total opportunity if you were underfunded to missed opportunity due to rank.

You got what you should’ve had for this year.

5. Review average CPC growth for the past two years by month.

Apply that growth to your CPC and cost (not impressions or clicks, though). I had a habit of annual growth of 3% to 5%.

6. Review January to August 2020 over 2019 growth/activity change (for election year impact).

Compare, and if there is incremental growth over the 2023 vs. 2022 percentage, raise your anticipated metrics.

This will help account for the incremental impact of the election.

Note: If there is a dip in the performance, I play the conservative side and don’t forecast metrics going down to avoid being shy about funds later.

7. Repeat Steps 1 through 6 for September through election day.

This is what I am calling “Election Impact.”

8. Repeat Steps 1 through 6 for the day after the election through New Year.

This rechecks your numbers. It also helps account for the peak shopping season.

9. Add the three timeframes together, and you have your budget.

If you change optimization strategies, roll out new creative, etc. – those that allow for flexible range variances – where you give the CPCs a variance, which leads to providing a budget range vs. that of a single number.

Now, Performance Max is a bit unpredictable.

For those inheriting campaigns, it is always good to review performance (especially on brand and PLAs) before PMax was involved and after it was involved.

This will give you a direction on its potential impact. Then, look at the historical spend by day over time to try and see if you can determine a baseline for spend.

The real kicker is that, back in 2020, PMax wasn’t a thing. So, the historical impact of events such as the election can’t be overlaid on it.

I look at growths in search CPC, YouTube cost-per-view (CPVs)/cost-per-thousand-impressions (CPMs), and GDN CPMs and look for commonalities. Then, apply that anticipated growth to the cost per interaction to try and back into my numbers.

Yes, this is very dirty math. But it also reiterates that impression share doesn’t carry the same weight in search/Display/YouTube as it once did because PMax is in there.

Lastly, I dig into GDN/MSAN and YouTube. These are a bit easier to anticipate because they have an impression share.

You can use a similar formula to search (Steps 1 to 9), but you’ll definitely want to shave some cost off the top to account for PMax (if you use it).

If you aren’t inheriting campaigns for MSAN/GDN/YouTube, then I recommend using Reach Planner for YouTube planning.

For GDN/MSAN, build audience targets, do the math for the population within your market (if it isn’t nationwide), and give yourself a test budget to work with and run with it from there.

Like that, you have a 2024 that attempts to account for the current state of society and its foreseeable transition and restlessness for later in the year.

Tips For SEM Planning In An Election Year

Now, that is all well and good – unless you are handling one of the verticals prone to be affected by interest rates, elections, and social issues (basically anything that can be politicized).

Your process will be similar but not entirely the same. This adjustment is applied to Step 7 in the prior section.

Determine the total opportunity that should’ve been with impression share lost in 2023. Then, scale CPC/CPM/CPV for two years and in 2020 for pre-election (call it June to August) vs. election (September to Election day 2020).

This delta should be applied to your earlier forecasts, providing the growth rate exceeded

Note: If you’re doing 3% to 5% annual growth, scale for year-on-year (i.e., a compounded 5% CPC for two years comes out to a 10.25% growth rate).

But let’s say election season causes the increase to 7% instead of 5%; then you’ll utilize that for one of your two years.

Once I Have My Traffic Numbers, What Should I Do Now?

Well, you could do nothing. But that would be a terrible idea.

Instead, apply historically normalized (follow data history from above to find “normalized”) post-click performance data, such as conversion rate (CVR), cost per acquisition (CPA), etc., to your delivery numbers. This will give you your expected back-end performance for the year.

But remember to exercise caution here.

Apparently, all it takes is civil unrest from an election, a pandemic, new fears of economic collapse, or a return of the murder hornets – and your hard-planned approach to budget and strategy will need to be redone.

If there’s only one thing you take away from this, expect the back half of the year to be a wild ride.

More resources:

Featured image: Shutterstock/N ON NE ON