New research suggests that manufacturing marketers — like a lot of other B2B marketers — only feel “average” about their content marketing.

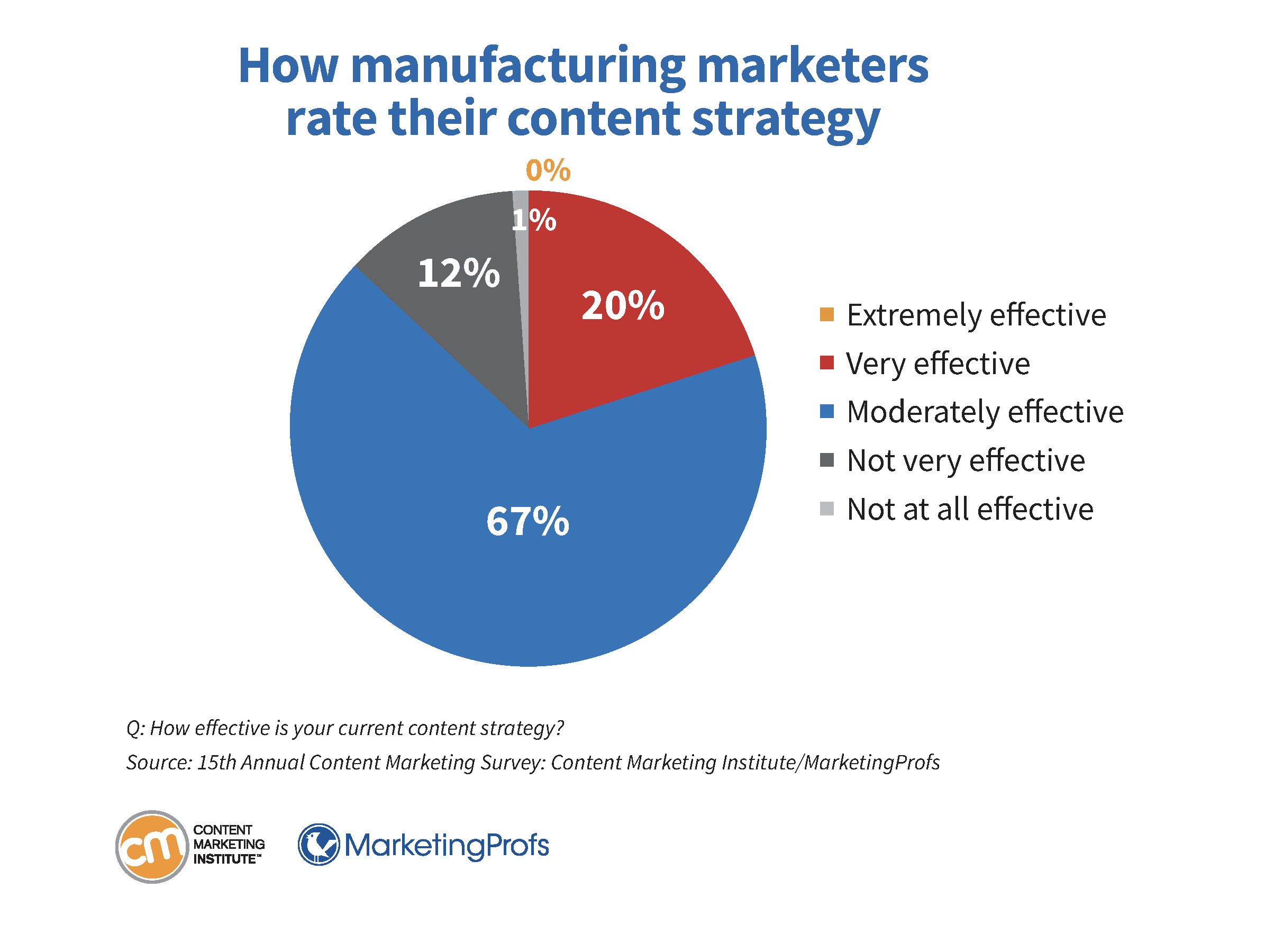

Sixty-seven percent of manufacturing marketers say their content strategy is moderately effective. Thirteen percent say it is not very or at all effective, and only 20% say it is very effective, according to the Content Marketing Institute’s annual survey conducted with MarketingProfs.

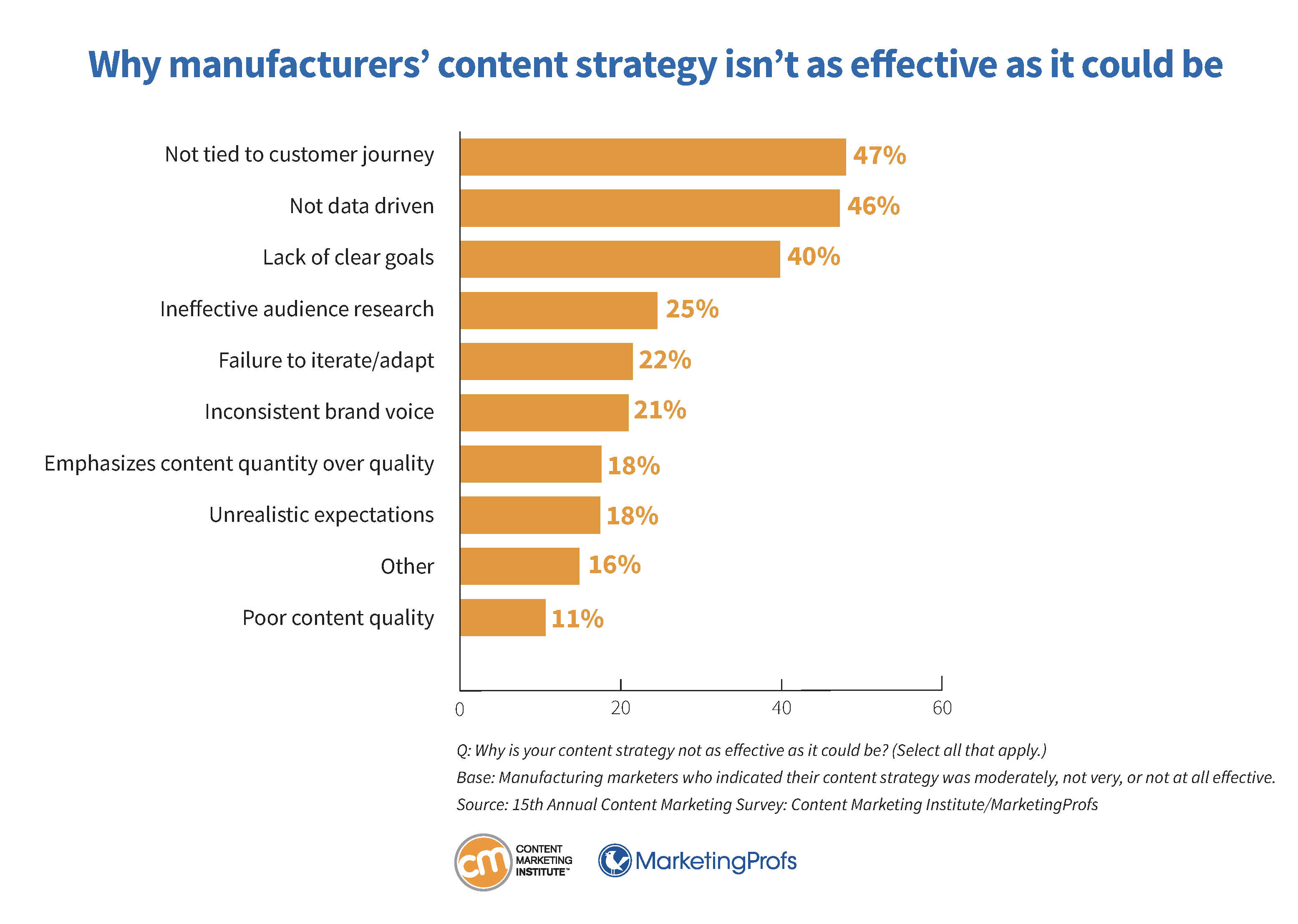

Manufacturing marketers say the main reasons why their strategies are not as effective as they could be is because they are not tied to the customer journey (47%), are not data driven (46%), and/or lack clear goals (40%).

Fewer than half blame:

- Ineffective audience research (25%)

- Failure to iterate/adapt (22%)

- Inconsistent brand voice (21%)

- Emphasizing content quantity over quality (18%)

- Unrealistic expectations (18%)

- Other (16%)

- Poor content quality (11%)

Content challenges: Creating enough that converts

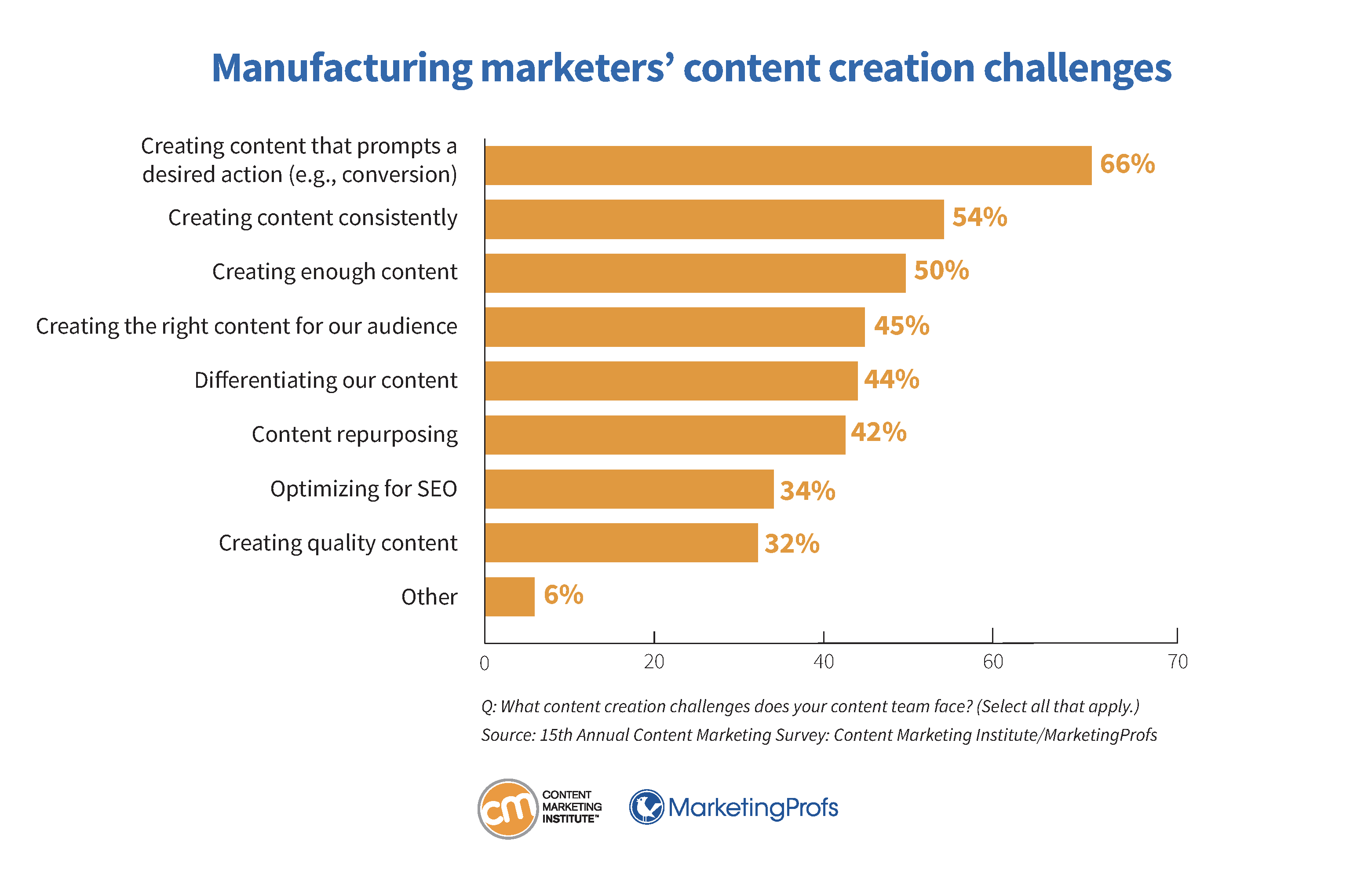

Sixty-six percent of manufacturing marketers say creating content that prompts a desired action is challenging. Fifty-four percent say creating content consistently is a challenge, and half say creating enough content is. Other challenges include:

- Creating the right content for our audience (45%)

- Differentiating our content (44%)

- Content repurposing (42%)

- Optimizing for SEO (34%)

- Creating quality content (32%)

- Other (6%)

Senior Brand and Content Strategist TREW Marketing

Morgan Norris, senior brand and content strategist, TREW Marketing, explains why these content challenges may exist and how to overcome them:

Technical marketers sometimes stall because they don’t know what to create or what type of content will resonate with their prospects and customers. If this is you, try sitting in on a few sales calls to better understand what your customers are experiencing and how your products or services solve their challenges. Listen for the specific words they use to frame their problem and how they’ve tried to fix it thus far. Identify topics and content pieces that would attract these prospects earlier, and content that would help them make a purchase decision faster. Getting pushback from sales? Ask for call recordings or transcripts from their meetings and start with those.

Situational issues: Lack of resources

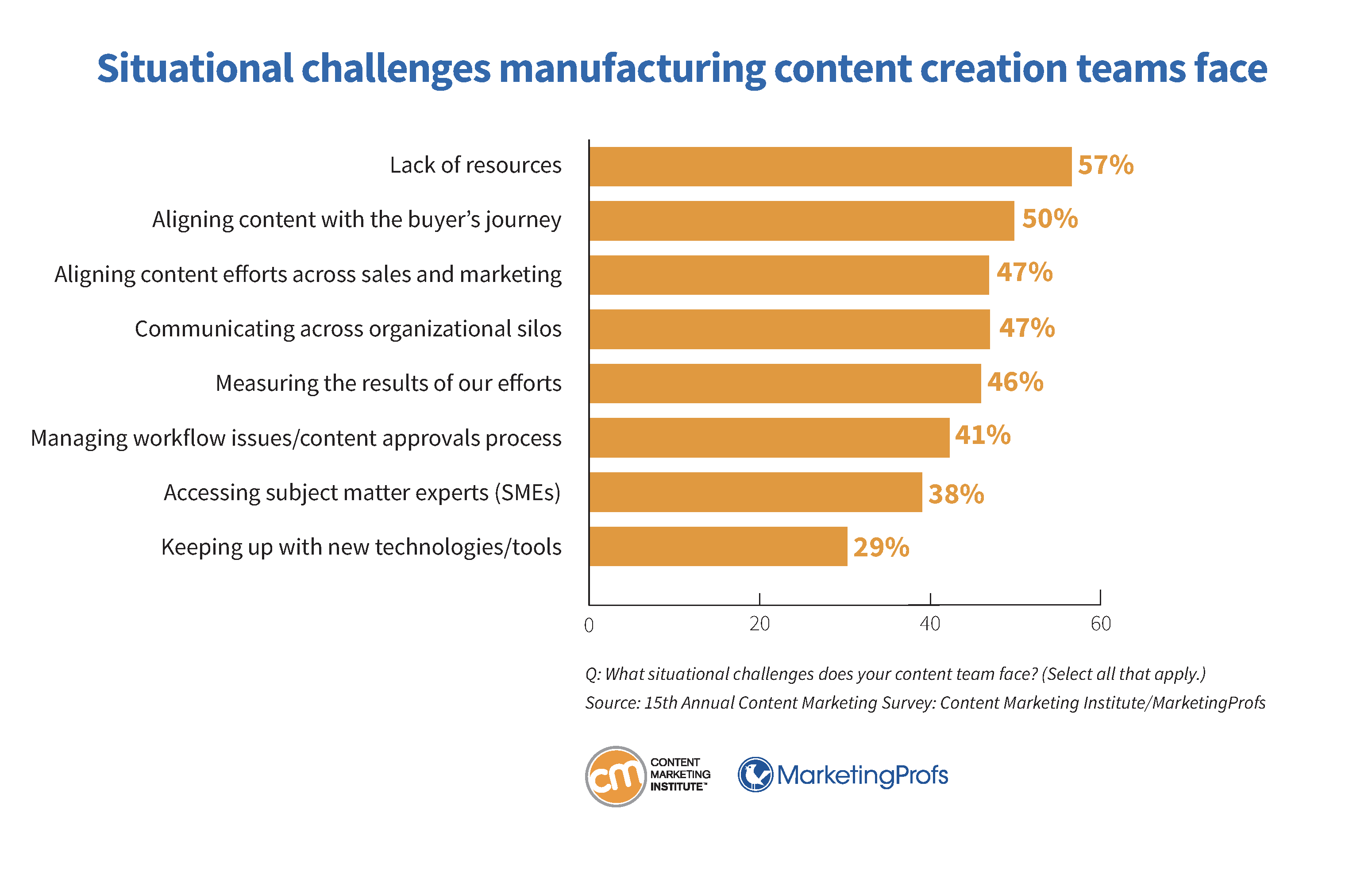

Manufacturing marketers’ most common pressing situational challenge is a lack of resources (57%), and half say they’re challenged in aligning content with the buyer’s journey. Other challenges include:

Measurement challenges: Tying to business goals

Manufacturing marketers split in their assessment of how well they analyze performance — 45% agree that they measure effectively, and 34% disagree. Seventeen percent neither agree nor disagree, and 5% don’t measure effectiveness at all.

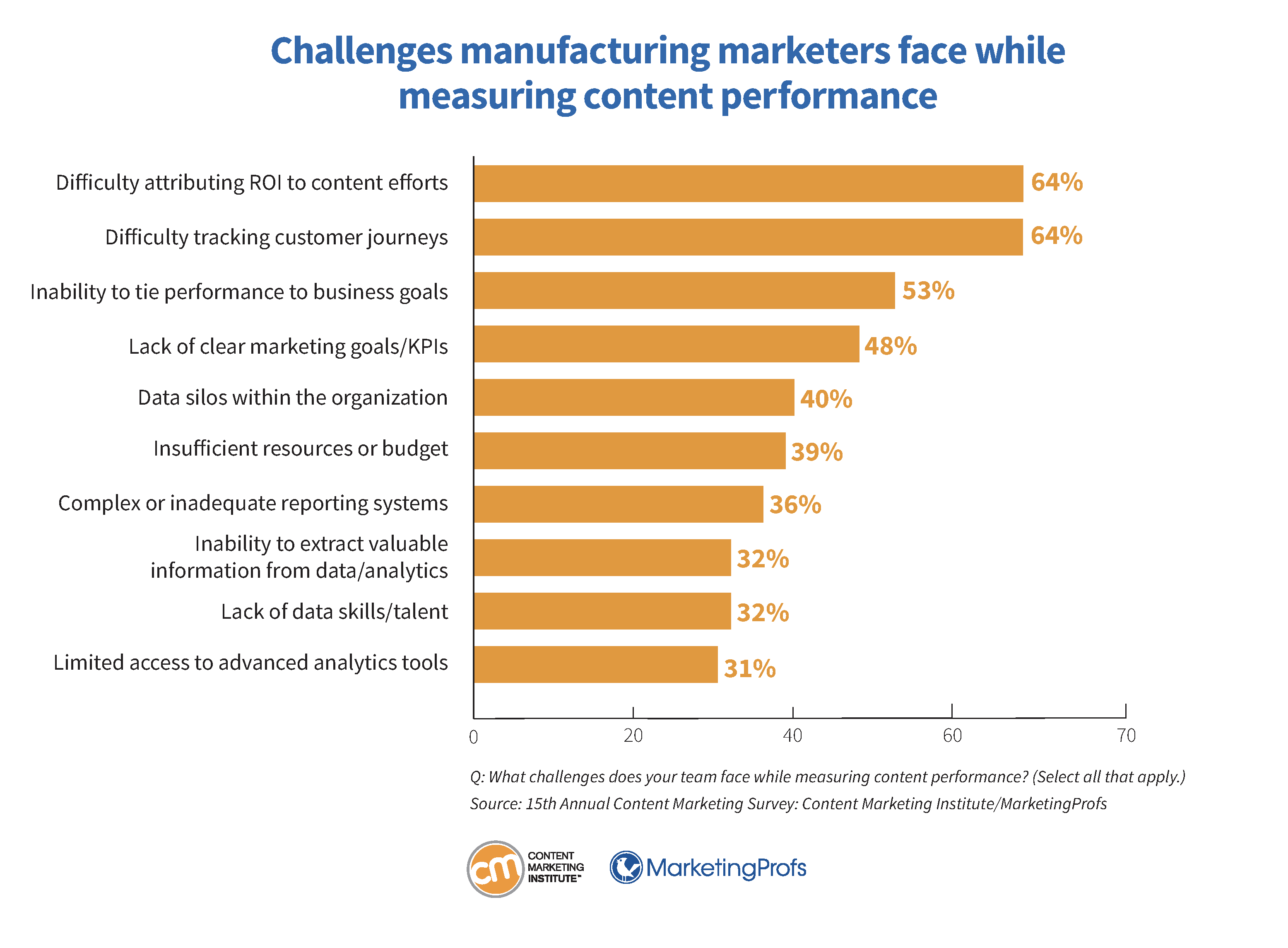

So, what kind of challenges do they face while measuring content performance? Sixty-four percent say they have difficulty attributing ROI to content efforts and tracking customer journeys. Other challenges include:

- Inability to tie performance to business goals (53%)

- Lack of clear marketing goals/KPIs (48%)

- Data silos within the organization (40%)

- Insufficient resources or budget (39%)

- Complex or inadequate reporting systems (36%)

- Inability to extract valuable information from data/analytics (32%)

- Lack of data skills/talent (32%)

- Limited access to advanced analytics tools (31%)

Content management issues: Technology’s potential

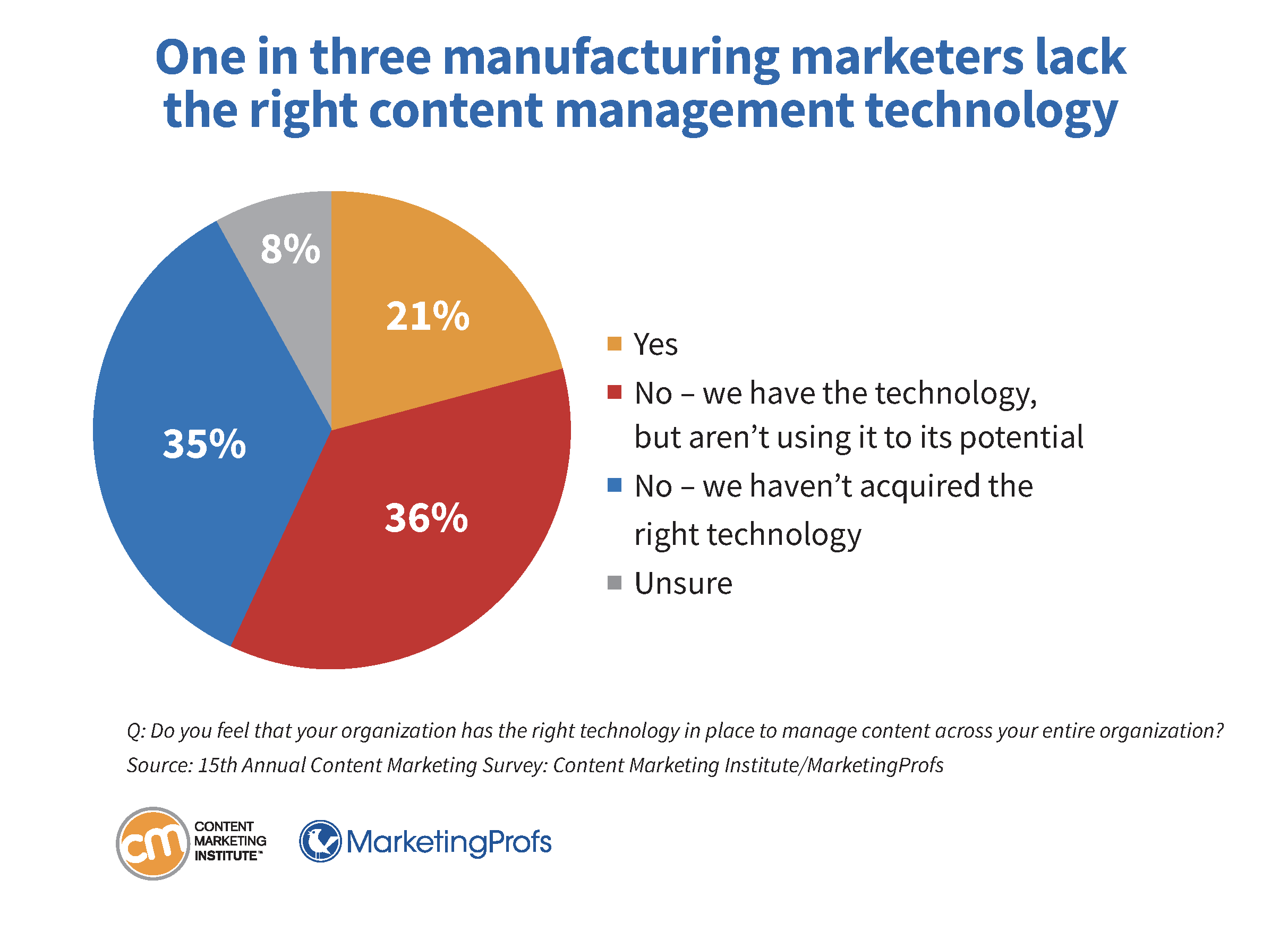

Only 21% of manufacturing marketers tell us they have the right technology, while 36% say they have the technology but aren’t using it to its potential. Thirty-five percent say they haven’t acquired the right technology, and 8% are unsure.

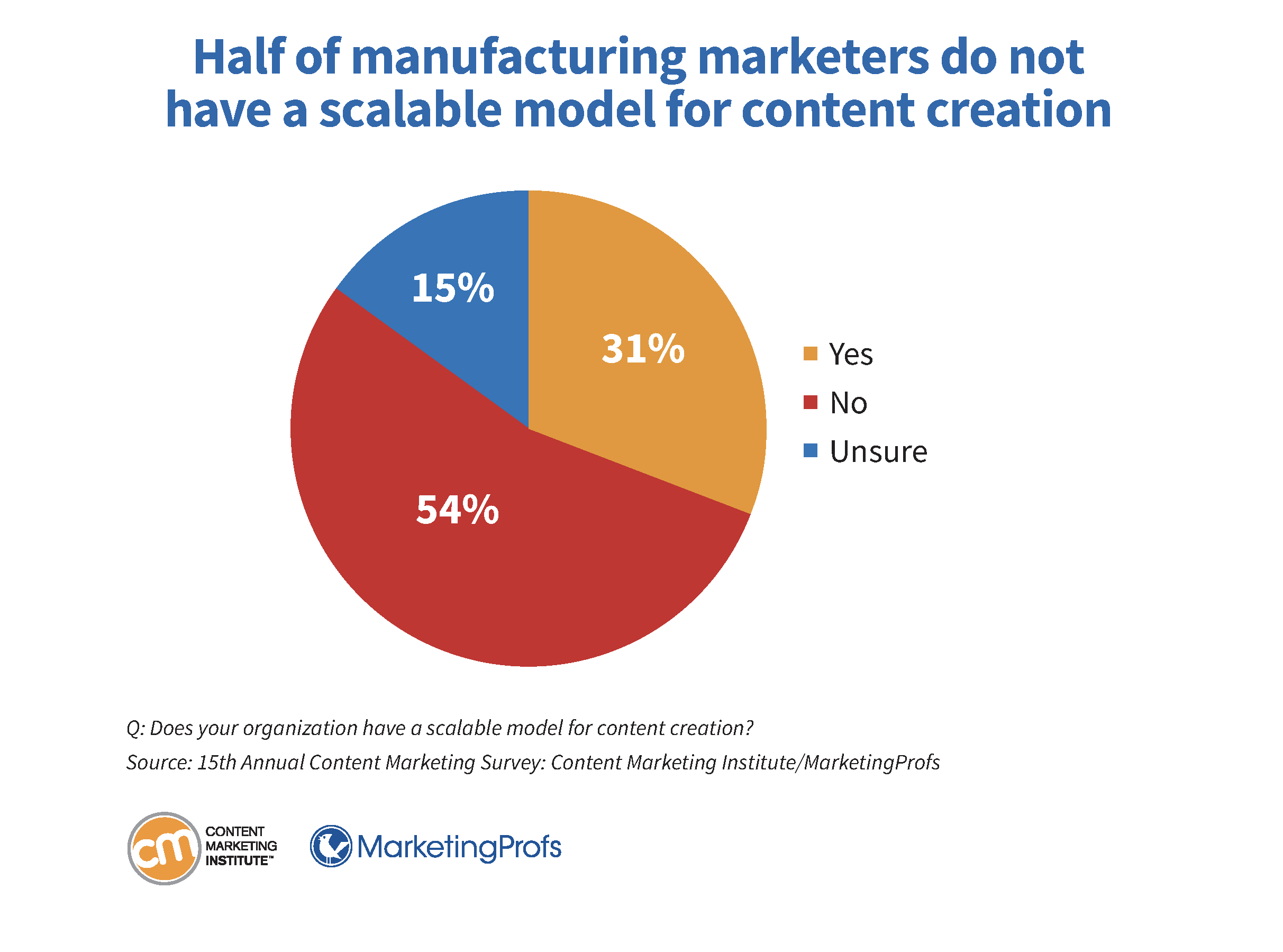

In addition, more than half (54%) of manufacturing marketers lack a scalable model for content creation. Thirty-one percent say they have a model, and 15% are unsure.

Tech stack hurdles: Lack of essential capabilities

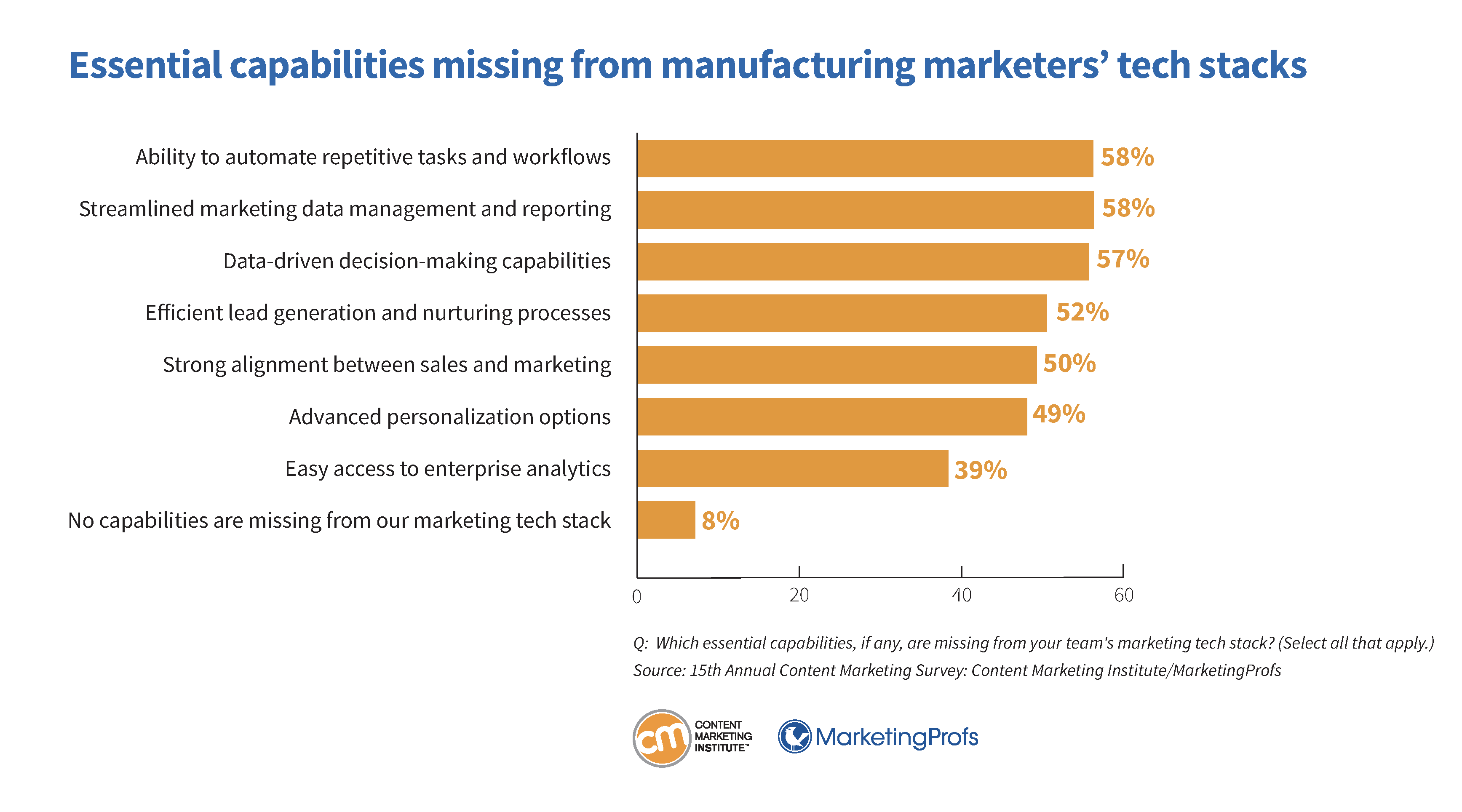

When asked which, if any, essential capabilities are missing from their tech stacks, 58% of manufacturing marketers say the ability to automate repetitive tasks and workflows. The same number also cite streamlined marketing data management and reporting as missing features. Other missing capabilities include:

- Data-driven decision-making capabilities (57%)

- Efficient lead generation and nurturing processes (52%)

- Strong alignment between sales and marketing (50%)

- Advanced personalization options (49%)

- Easy access to enterprise analytics (39%)

Eight percent say no capabilities are missing from their marketing tech stack.

AI matters: Minimal integration

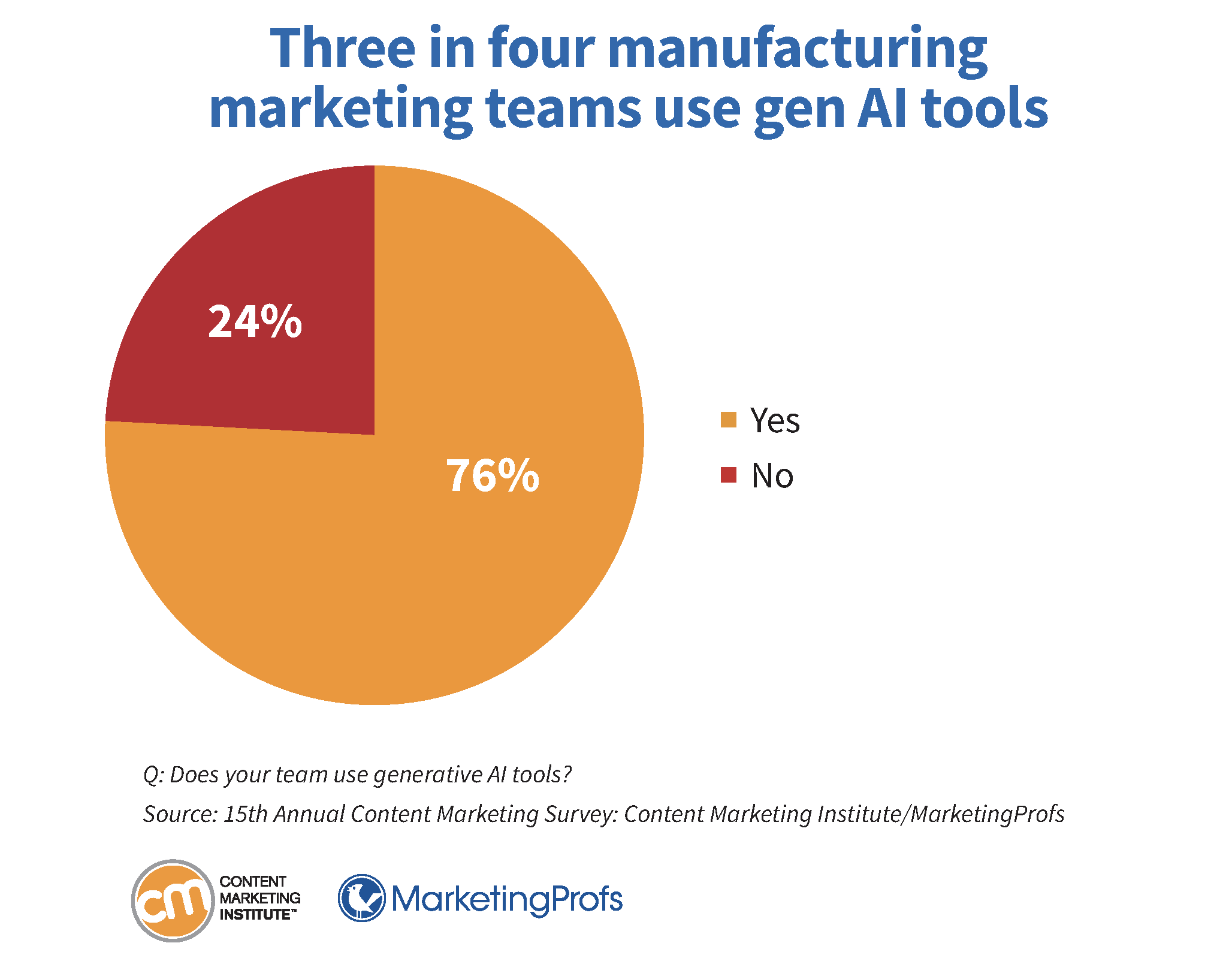

Seventy-six percent of manufacturing marketers report using generative AI tools, an adoption rate like other B2B marketers in the broader annual content marketing survey.

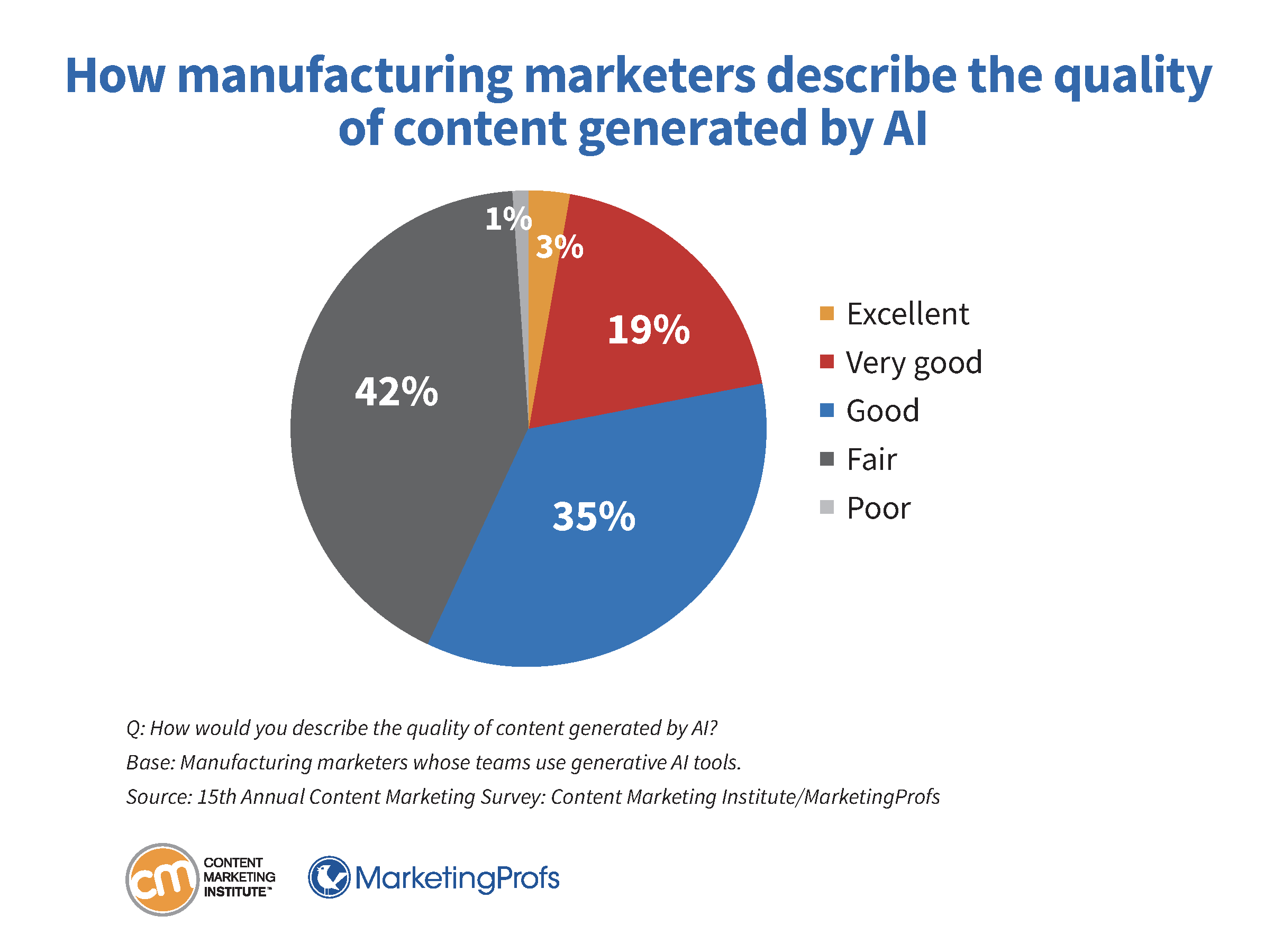

While 57% of manufacturing marketers describe the quality of content generated by AI as excellent, very good, or good, another 43% describe it as fair or poor. This latter group may be more wary of the content, which makes sense, considering the technical nature of the products they produce.

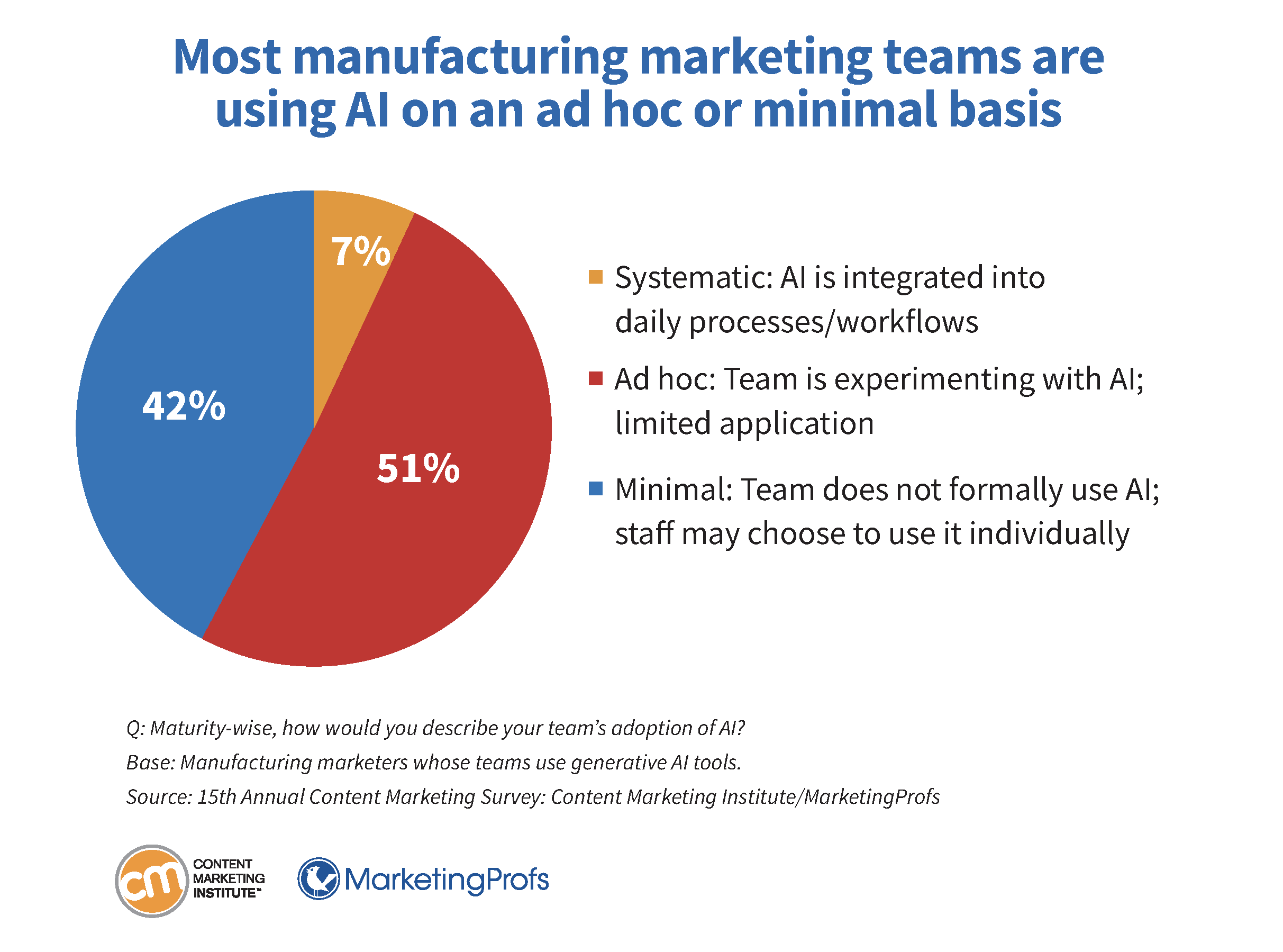

Regarding adoption, only 7% of manufacturing marketers say AI is integrated into daily processes/workflows. Around half (51%) say their teams experiment with AI on an ad hoc basis. Forty-two percent say their teams do not formally use AI, but individual staff may choose to use it.

Content Strategy & Marketing Manager Eaton

Craig Coffey, content strategy and marketing manager at Eaton, shares what may be happening with AI use and attitudes:

When it comes to the adoption of AI, I think a couple of things may be at play. First, I think manufacturing content marketers are being expectedly cautious about allowing LLMs to gain access to information that could be intellectual property (the “secret sauce”) related to their products; their due diligence process and learning curve are more cautious and protracted.

Second, manufacturing tends to lag the rest of B2B in the adoption of technology not because they don’t see the value but because of their tendency to be more long-term planners — chasing the shiny new thing isn’t in their DNA.

With all the AI tools and tech out there, manufacturing marketers may likely be looking further out, and instead of adopting technology that is cutting edge now, they’re making educated bets on which of these products might be acquired by larger martech providers and becoming features of their current tech stack, rather than standalone tools.

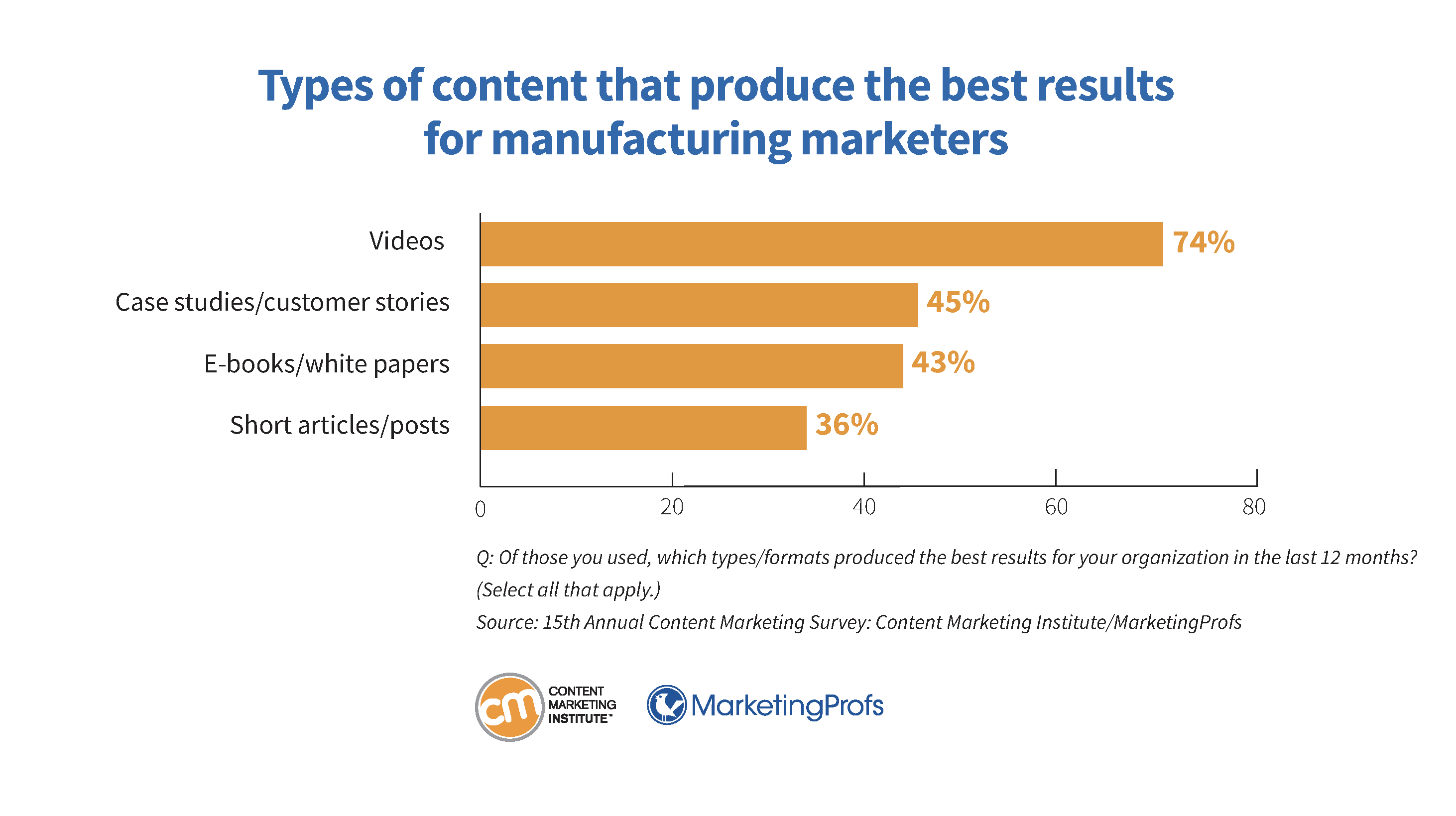

Content type trends: Video popular and effective

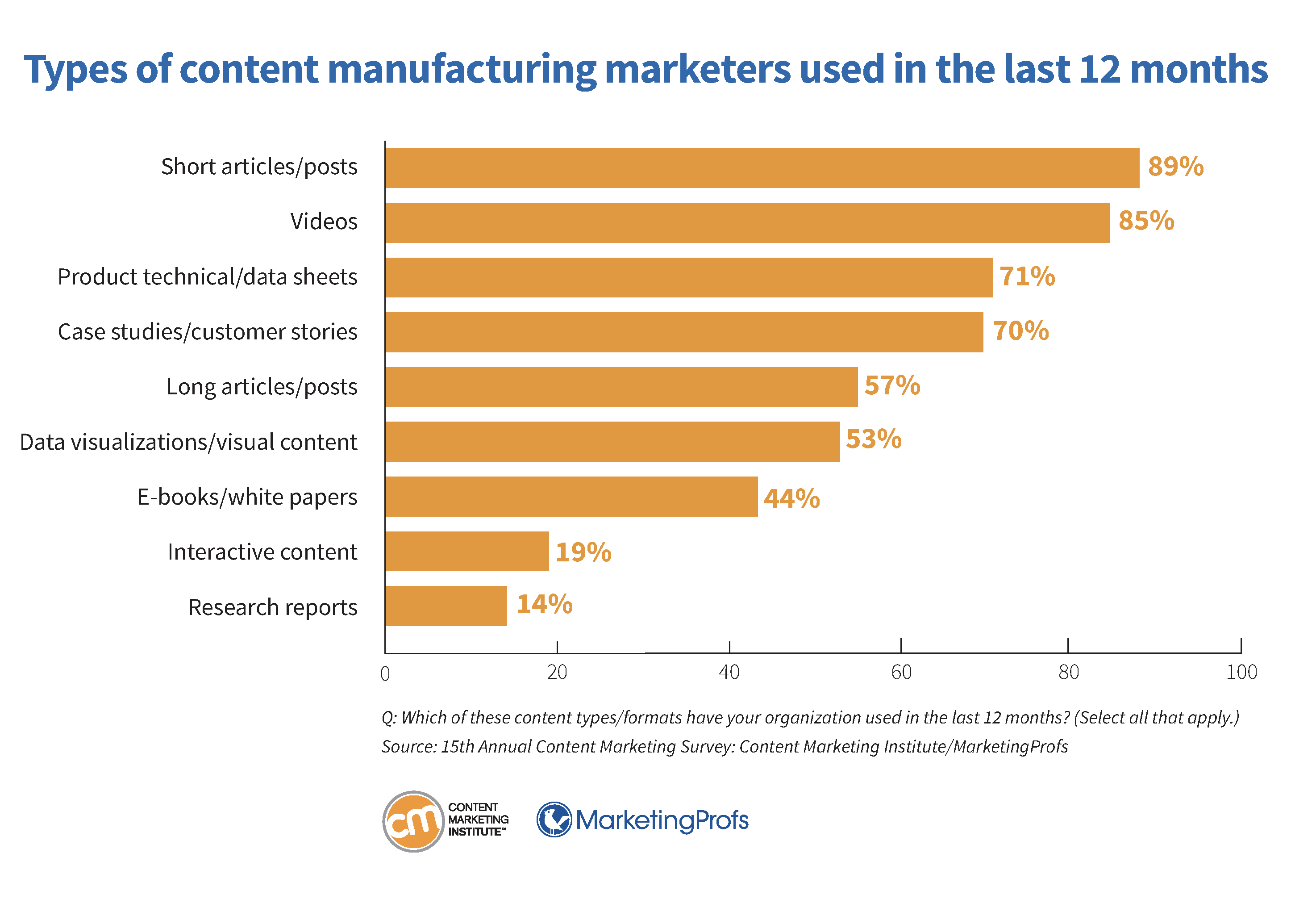

The two most popular types of content used by manufacturing marketers in the previous 12 months are short articles/posts (89%) and videos (85%). Other formats include product technical/data sheets (71%), case studies/customer stories (70%), long articles/posts (57%), data visualizations/visual content (53%), e-books/white papers (44%), interactive content (19%), and research reports (14%).

Of those content types, manufacturing marketers say videos are the most effective (74%), followed by case studies/customer stories (45%), e-books/white papers (43%), and short articles/posts (36%).

Head of Marketing Communications & Technical Training

Heatcraft Refrigeration Products

Pete Grasso, head of marketing communications and technical training, Heatcraft Refrigeration Products, shares why video works so well:

B2B companies can’t afford to be left behind in effective communication trends — our audiences are used to consuming video content from B2C brands, and we need to meet them where they are.

Videos allow us to simplify complex topics into engaging, digestible content, making sure we’re not just informing but genuinely connecting with our audience. Just because we’re in manufacturing doesn’t mean our content should be static or unengaging. Videos have transformed the way we share technical knowledge, keeping it fresh and accessible. The shift toward video isn’t just a trend; it’s a necessary adaptation, one that we’re embracing to stay impactful and relevant in our communication strategy.

Read about how Heatcraft Refrigeration Products uses video in its marketing.

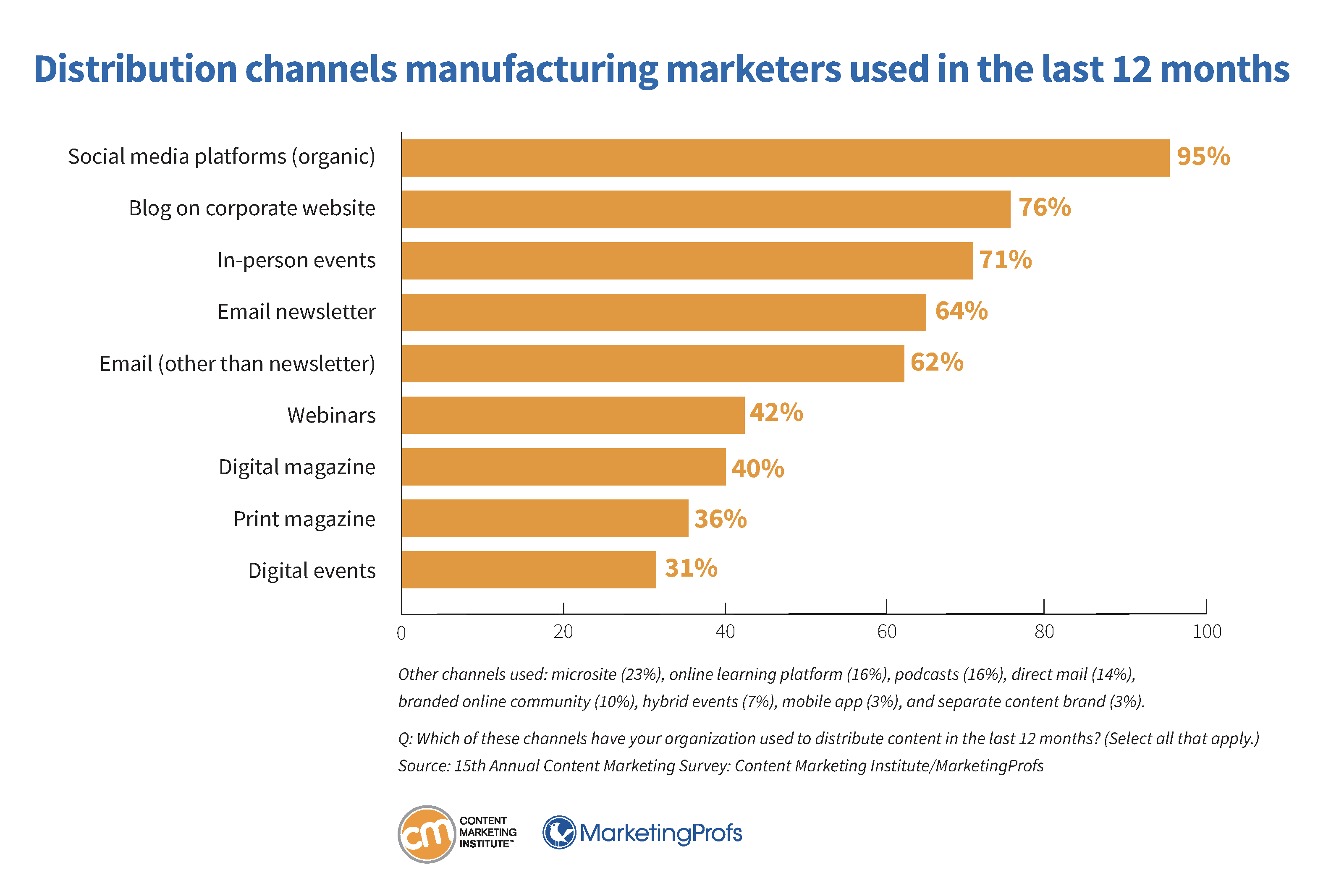

Distribution channel uses: Organic tops and in-person wins

Nearly all manufacturing marketers (95%) distributed content via organic social platforms in the last 12 months. Seventy-six percent published blogs on their corporate website, and 71% used in-person events. Other channels include:

- Email newsletter (64%)

- Email other than newsletters (62%)

- Webinars (42%)

- Digital magazine (40%)

- Print magazine (36%)

- Digital events (31%)

Less than one-fourth of manufacturing marketers used microsites (23%), online learning platforms (16%), podcasts (16%), direct mail (14%), branded online communities (10%), hybrid events (7%), mobile apps (3%), and separate content brands (3%).

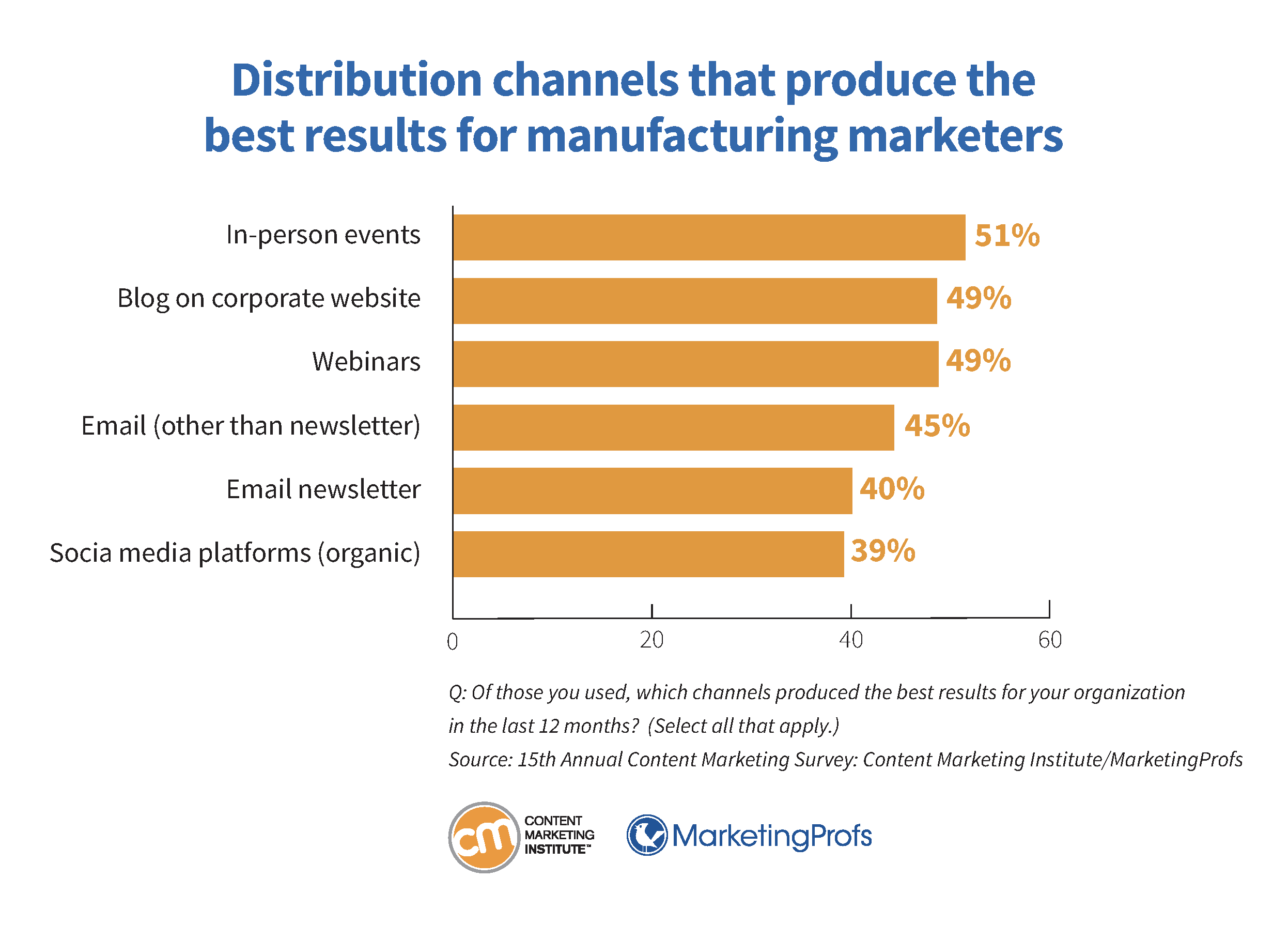

Manufacturing marketers say in-person events (51%) are their most effective distribution channel, followed closely by blogs on corporate websites (49%) and webinars (49%).

They also rate email (45%) as effective, as well as email newsletters (40%) and organic social media platforms (39%).

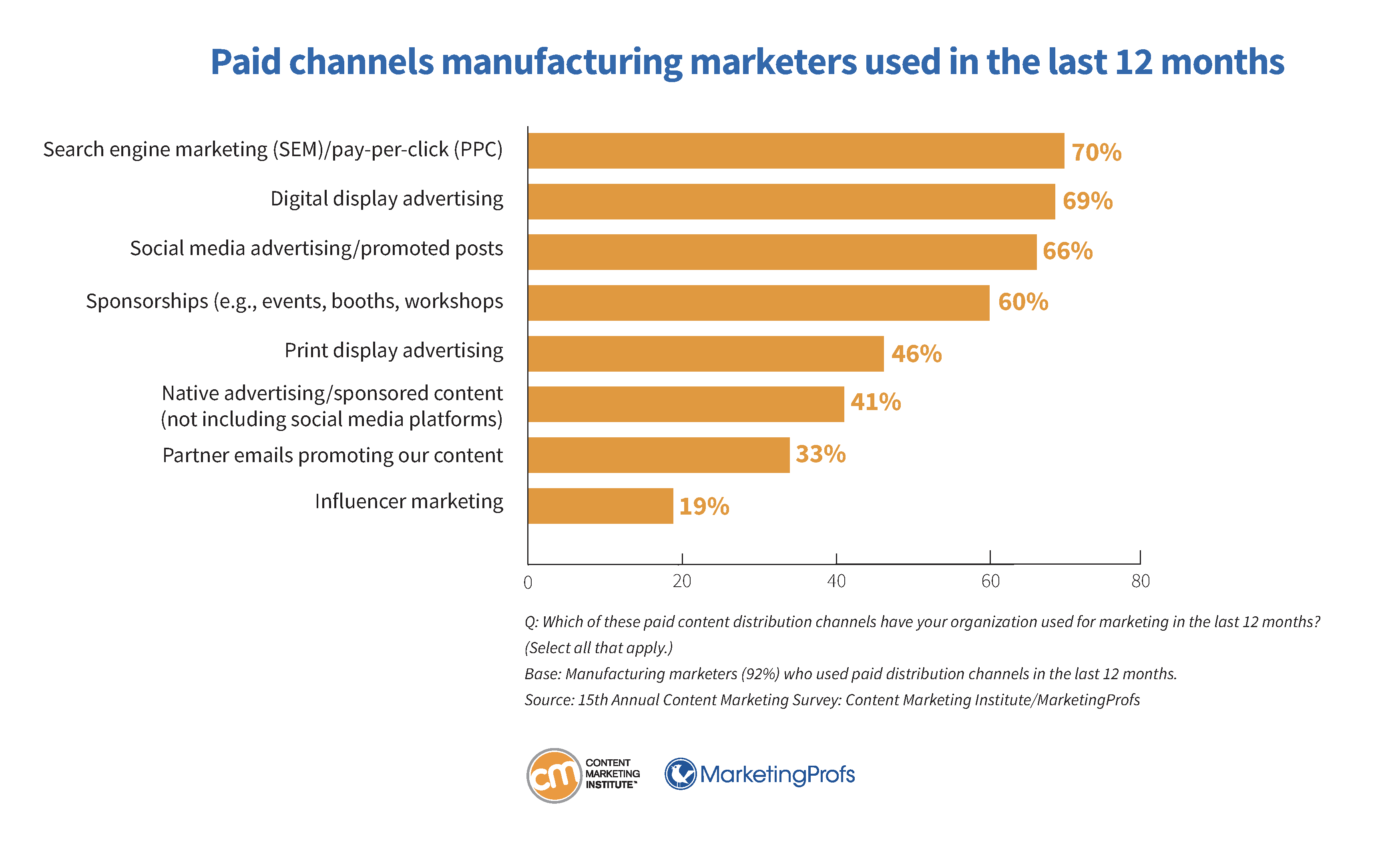

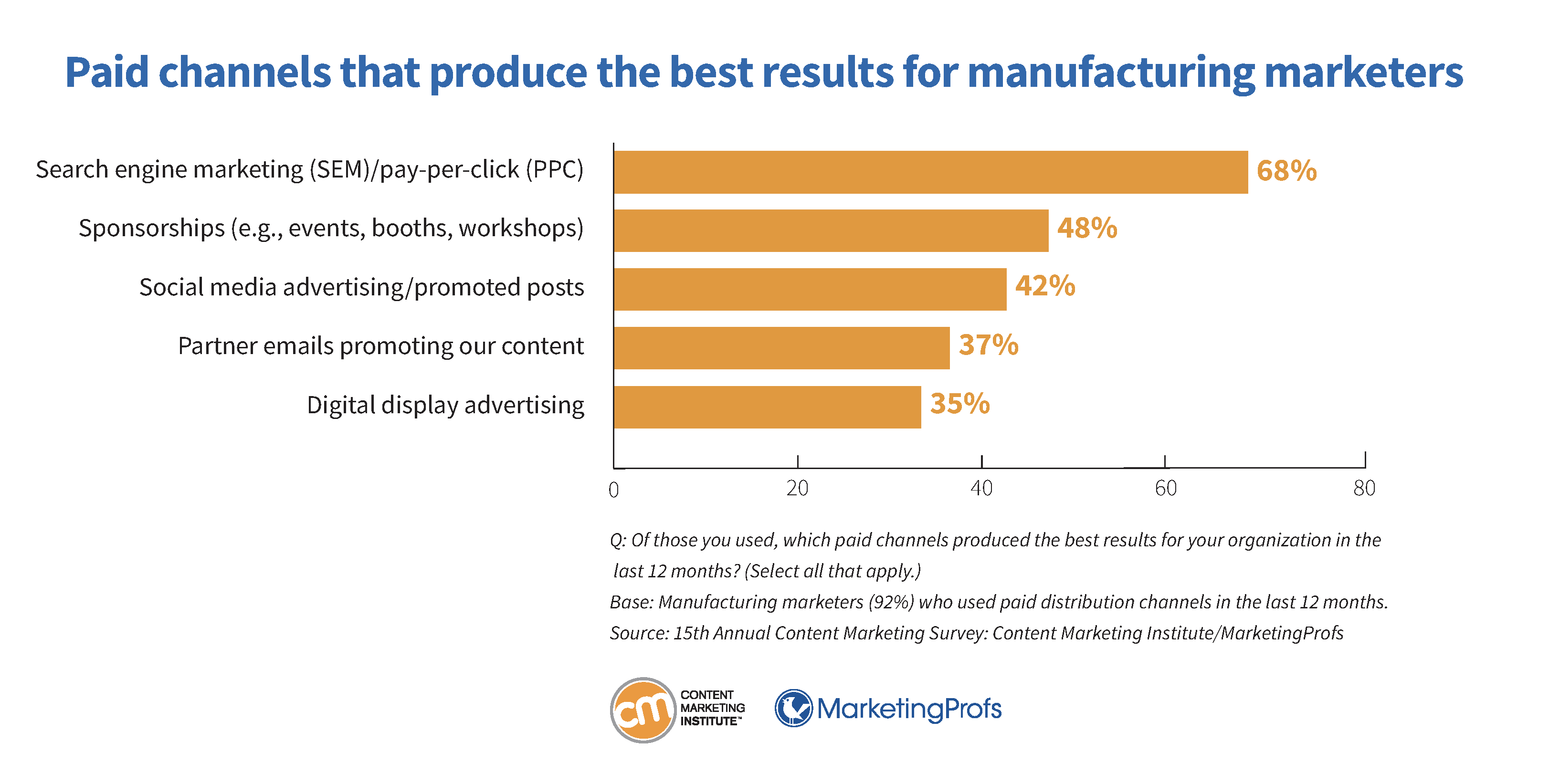

Paid channel applications: Search wins

Ninety-two percent of manufacturing marketers say they used paid channels in the last 12 months. Of those who did, 70% used search engine marketing (SEM)/pay-per-click (PPC). Other paid channels cited include:

- Digital display advertising (69%)

- Social media advertising/promoted posts (66%)

- Sponsorships — events, booths, workshops, etc. (60%)

- Print display advertising (46%)

- Native advertising/sponsored content, not including social media platforms (41%)

- Partner emails promoting our content (33%)

- Influencer marketing (19%)

Sixty-eight percent of manufacturing marketers cite search engine and pay-per-click marketing as producing the best paid-channel results. Forty-eight percent say sponsorships, followed by social media advertising/promoted posts (42%), partner emails promoting the brand’s content (37%), and digital display advertising (35%).

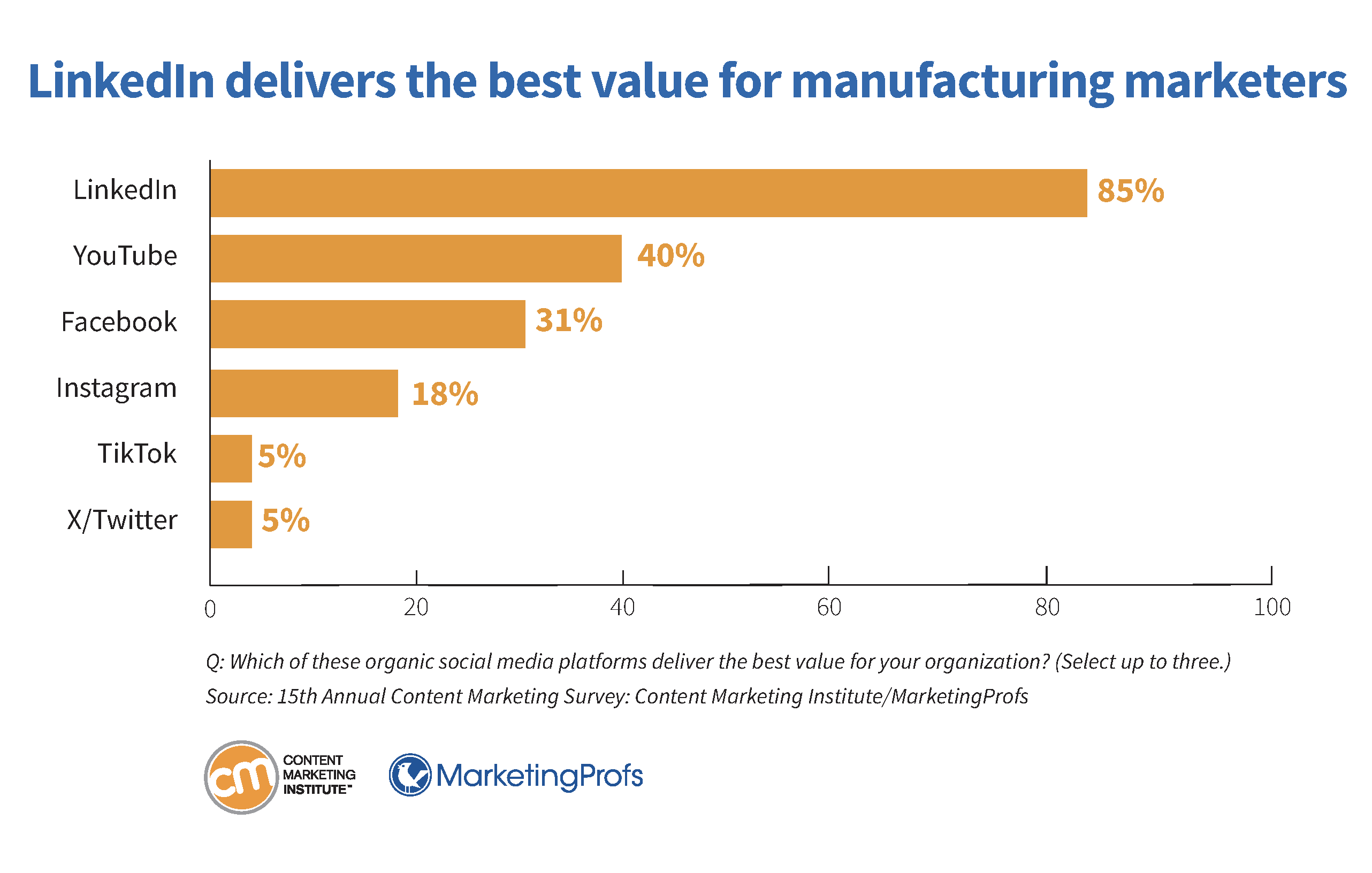

Social media use: LinkedIn tops, X sees drop

Most (85%) of manufacturing marketers, like most other B2B marketers, say LinkedIn is the social media platform that delivers the best value for their organization. Forty percent say YouTube delivers value, which makes sense considering the popularity and effectiveness of videos for manufacturing marketers. Here’s the breakdown by platforms that manufacturing marketers say deliver the best value:

- LinkedIn (85%)

- YouTube (40%)

- Facebook (31%)

- Instagram (18%)

- TikTok (5%)

- X/Twitter (5%)

Sixty-seven percent of manufacturing marketers increased their use of LinkedIn over the last 12 months. Thirty-five percent increased their use of YouTube, 26% on Instagram, 23% on Facebook, 10% on TikTok, 7% on Reddit, and 3% increased their use of X.

Of those marketers who spent less time on platforms, X saw the most decline (26%), while only 6% decreased their use of LinkedIn. Thirteen percent decreased their use of Instagram, 18% on Facebook, 4% on TikTok, and 2% on Reddit.

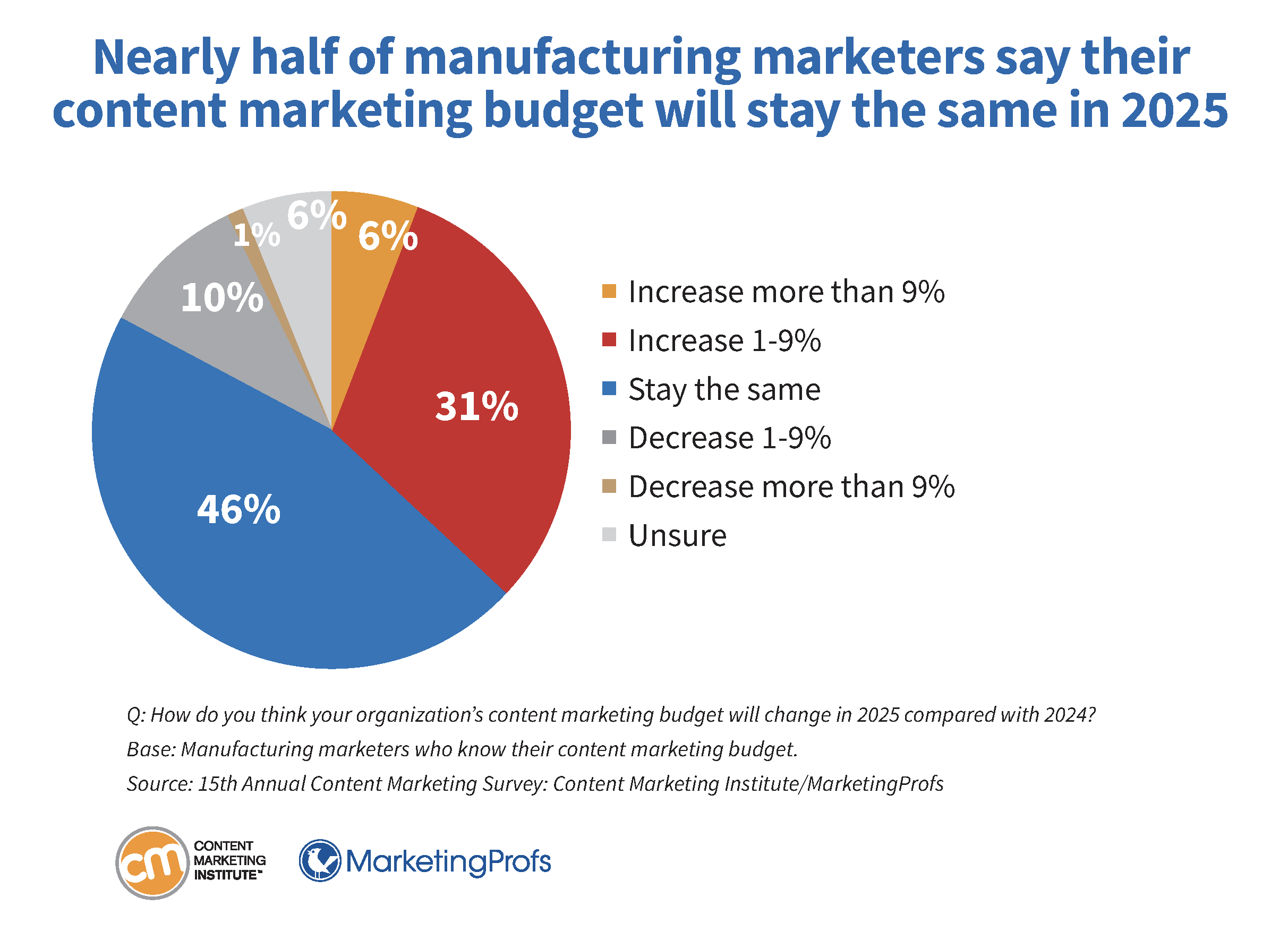

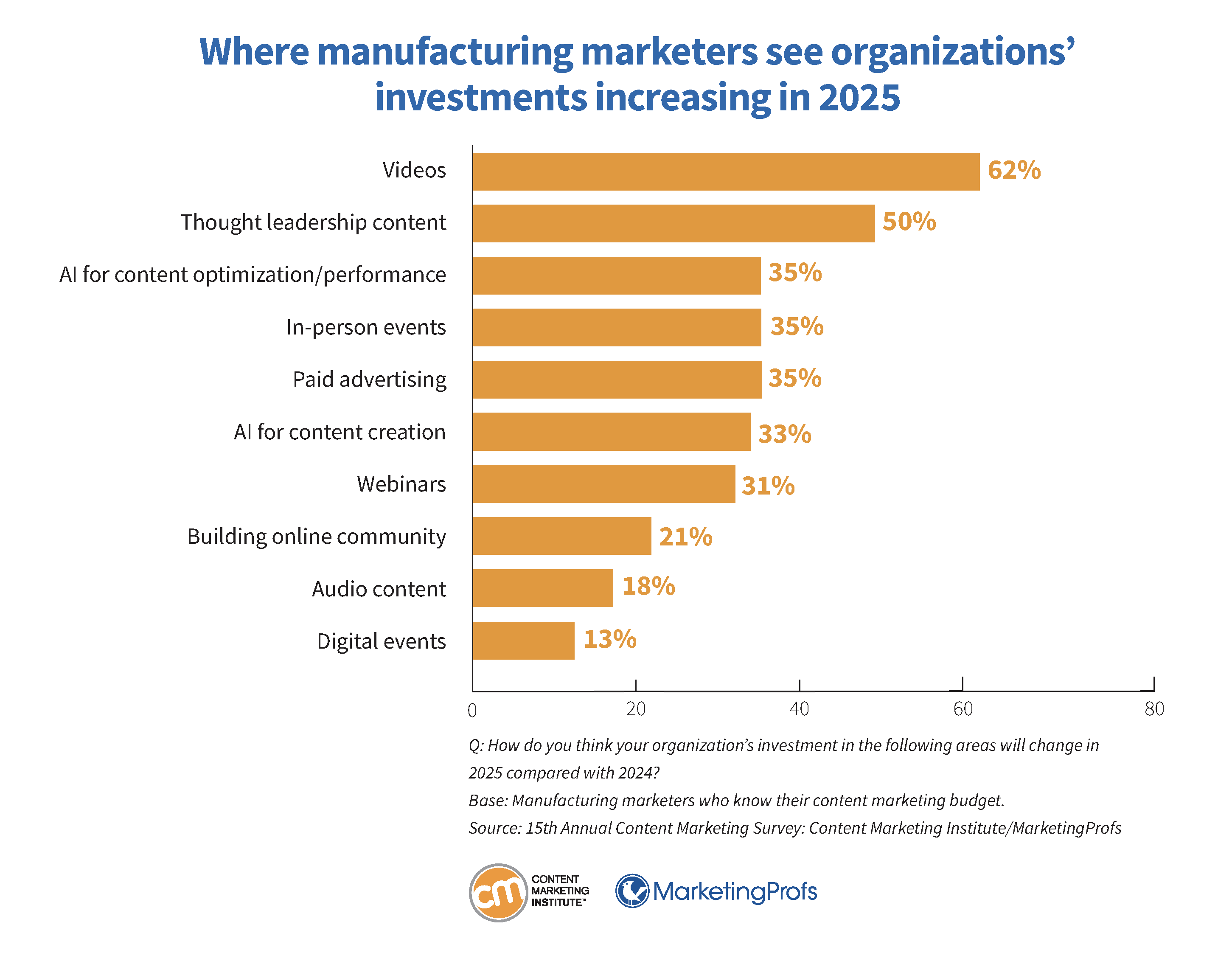

Budgets and spending trends: Flat but boosts in video, thought leadership

Thirty-seven percent of manufacturing marketers tell us they expected their content marketing budget to increase in 2025; however, more expected it to stay the same (46%), and 11% expect a decrease. Six percent are unsure.

At least half of manufacturing marketers predict increased investment for videos (62%) and thought leadership content (50%) in 2025. Other areas where they see increased investment include:

- AI for content optimization/performance (35%)

- In-person events (35%)

- Paid advertising (35%)

- AI for content creation (33%)

- Webinars (31%)

- Building online community (21%)

- Audio content (18%)

- Digital events (13%)

Looking toward 2025

To improve their content strategies, manufacturing marketers must continue to map strategy to the customer journey, have better access to customer data, and work with other internal teams to define clear goals for content marketing.

In the battle to produce enough content to meet their organizations’ needs, manufacturing marketers not only need to align with internal sales teams but also develop scalable models for content creation.

Manufacturing marketers report that they’re often strapped for resources, so identifying ways to get the most bang for their content buck will be critical in 2025, especially when many expect their content marketing budgets to stay flat in the year ahead.

Methodology

Content Marketing Institute conducts an annual survey with MarketingProfs every year. These findings come from the 104 manufacturing participants of the 1,186 marketers around the globe who responded between June and August 2024.

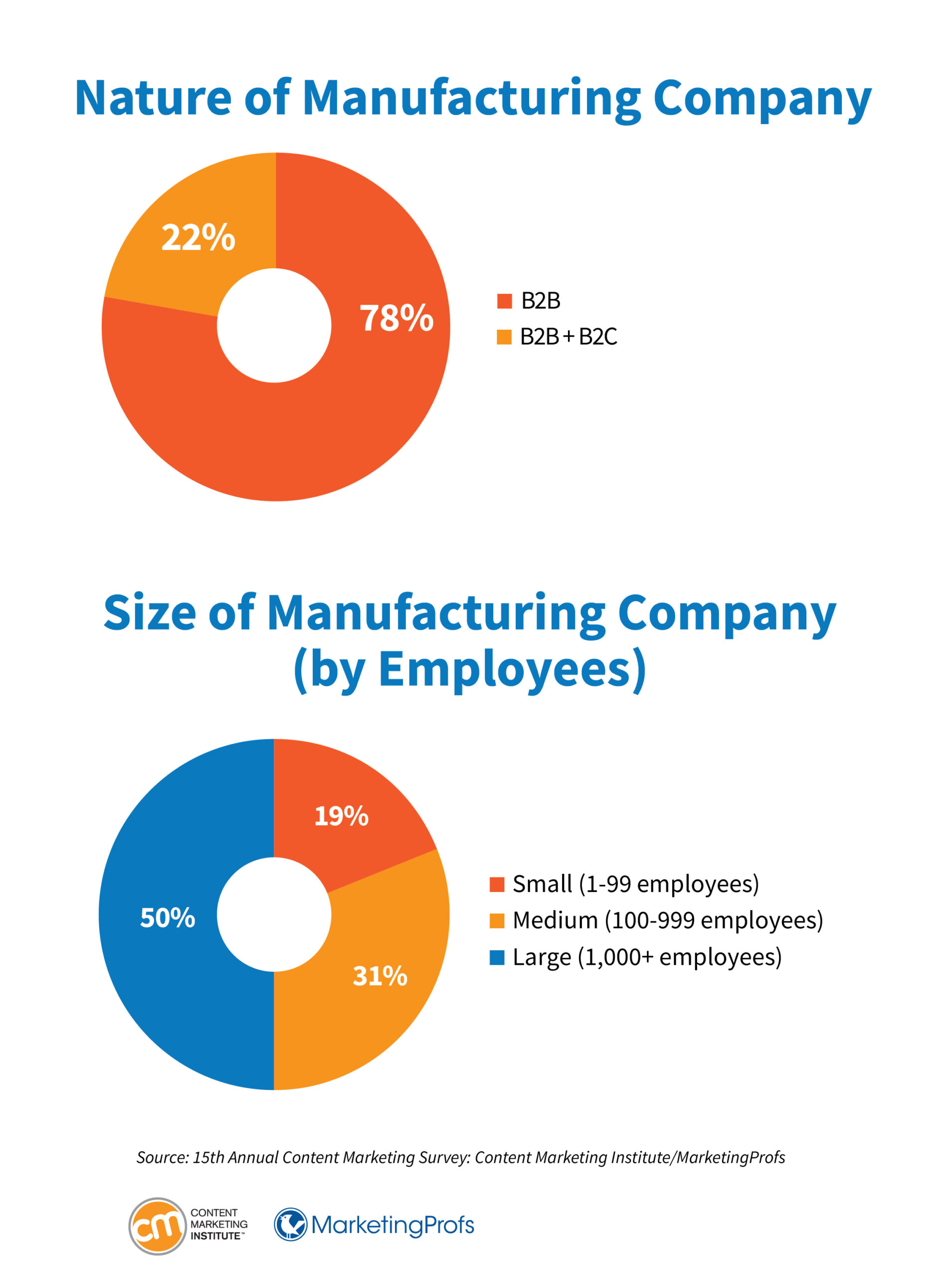

Seventy-eight percent of the manufacturing marketers work for B2B brands, while 22% work for B2B and B2C brands.

These marketers work in manufacturing companies of these employee sizes:

- One to 99 employees (19%)

- 100 to 999 employees (31%)

- 1,000-plus employees (50%)

HANDPICKED RELATED CONTENT:

Cover image by Joseph Kalinowski/Content Marketing Institute